Growing Construction Sector

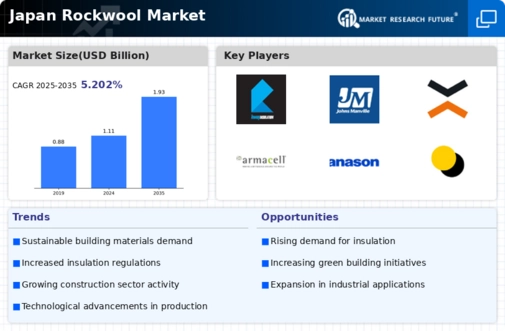

The Japan rockwool market is experiencing a notable surge due to the expanding construction sector. With the government promoting infrastructure development and urban renewal projects, the demand for insulation materials, including rockwool, is on the rise. In 2025, the construction output in Japan was estimated to reach approximately 60 trillion yen, indicating a robust growth trajectory. This growth is further fueled by the increasing focus on energy efficiency and sustainable building practices, which necessitate the use of high-performance insulation materials. Rockwool, known for its excellent thermal and acoustic insulation properties, is becoming a preferred choice among builders and architects. As the construction sector continues to flourish, the Japan rockwool market is likely to benefit significantly from this trend.

Increased Awareness of Fire Safety

Fire safety concerns are becoming increasingly prominent in Japan, significantly impacting the Japan rockwool market. Rockwool is renowned for its fire-resistant properties, making it an ideal choice for various applications, particularly in commercial and industrial buildings. The recent rise in awareness regarding fire hazards has led to stricter building codes and safety regulations, which favor the use of non-combustible insulation materials like rockwool. In 2025, the market for fire-resistant insulation materials was projected to grow by 15%, reflecting the heightened focus on safety. Consequently, the Japan rockwool market is likely to see a surge in demand as builders and developers prioritize fire safety in their projects.

Regulatory Support for Energy Efficiency

The Japan rockwool market is bolstered by stringent regulations aimed at enhancing energy efficiency in buildings. The government has implemented various policies that mandate the use of high-quality insulation materials to reduce energy consumption. For instance, the Energy Saving Act encourages the adoption of insulation solutions that meet specific thermal performance standards. This regulatory framework not only promotes the use of rockwool but also aligns with Japan's commitment to reducing greenhouse gas emissions. As a result, the market for rockwool insulation is expected to expand, driven by compliance with these regulations. The emphasis on energy-efficient buildings is likely to create a favorable environment for the Japan rockwool market, as more construction projects seek to incorporate sustainable materials.

Technological Innovations in Manufacturing

The Japan rockwool market is witnessing a wave of technological innovations that enhance the production and performance of rockwool products. Advances in manufacturing processes have led to the development of high-density rockwool that offers superior insulation properties and durability. These innovations not only improve the efficiency of rockwool but also reduce production costs, making it a more attractive option for builders. Furthermore, the integration of smart technologies in insulation solutions is gaining traction, allowing for better energy management in buildings. As these technological advancements continue to evolve, the Japan rockwool market is poised for growth, driven by the demand for high-performance insulation materials.

Rising Demand for Sustainable Building Materials

The Japan rockwool market is increasingly influenced by the rising demand for sustainable building materials. As environmental consciousness grows among consumers and businesses, there is a marked shift towards materials that are eco-friendly and recyclable. Rockwool, being made from natural volcanic rock, aligns well with these sustainability goals. In 2025, the market for sustainable insulation materials was expected to account for over 30% of the total insulation market in Japan. This trend is further supported by government initiatives promoting green building certifications, which often require the use of sustainable materials. Consequently, the Japan rockwool market is likely to experience significant growth as more projects aim to meet these sustainability criteria.