Increased Corporate Investment

The non fungible-tokens market in Japan is witnessing a surge in corporate investment, as businesses recognize the potential of NFTs for brand engagement and customer loyalty. Major companies are exploring the use of NFTs for marketing campaigns, exclusive content, and digital merchandise. In 2025, it is projected that corporate spending on NFTs in Japan could exceed $200 million, indicating a growing acceptance of digital assets in traditional business models. This trend is likely to enhance the visibility and credibility of the non fungible-tokens market, attracting more consumers and investors. As corporations leverage NFTs to create unique experiences, the market may see an influx of innovative projects that further drive its growth. This corporate interest could also lead to collaborations between brands and artists, enriching the cultural landscape of the non fungible-tokens market.

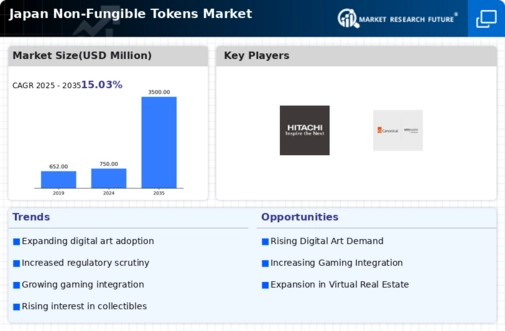

Rising Interest in Digital Art

The non fungible-tokens market in Japan is experiencing a notable surge in interest surrounding digital art. Artists and collectors are increasingly recognizing the value of digital creations, leading to a vibrant marketplace. In 2025, the sales of digital art NFTs in Japan are projected to reach approximately $300 million, reflecting a growth of 25% from the previous year. This trend is driven by the unique ability of NFTs to authenticate ownership and provenance, which appeals to both artists and buyers. The integration of traditional art forms with digital mediums is fostering a new wave of creativity, thereby enhancing the overall appeal of the non fungible-tokens market. As more artists enter this space, the demand for unique digital artworks is likely to continue its upward trajectory, further solidifying Japan's position as a key player in the global NFT landscape.

Growing Popularity of Gaming NFTs

The gaming sector is becoming a pivotal driver for the non fungible-tokens market in Japan, as developers and players alike embrace the concept of digital ownership. The integration of NFTs into gaming allows players to own, trade, and sell in-game assets, creating a new economy within the gaming ecosystem. In 2025, the revenue generated from gaming-related NFTs in Japan is expected to reach $150 million, reflecting a 30% increase from the previous year. This growth is fueled by the rising popularity of play-to-earn models, where players can earn real value through their gaming activities. As more game developers adopt NFT technology, the non fungible-tokens market is likely to expand, attracting a diverse audience of gamers and collectors. This trend may also encourage innovation in game design, as developers explore new ways to incorporate NFTs into gameplay.

Technological Advancements in Blockchain

Technological advancements in blockchain are significantly influencing the non fungible-tokens market in Japan. The introduction of more efficient and scalable blockchain solutions is enabling faster transactions and lower fees, which are critical for attracting a broader audience. In 2025, it is estimated that transaction speeds on leading blockchain platforms will improve by up to 50%, enhancing user experience. Furthermore, the development of Layer 2 solutions is allowing for greater interoperability between different NFT platforms, which could potentially increase market liquidity. As these technologies evolve, they are likely to empower creators and collectors alike, fostering innovation within the non fungible-tokens market. This technological evolution may also lead to the emergence of new use cases for NFTs, such as in gaming and virtual reality, thereby expanding the market's reach.

Cultural Shifts Towards Digital Ownership

Cultural shifts in Japan are increasingly favoring the concept of digital ownership, which is significantly impacting the non fungible-tokens market. As younger generations become more accustomed to digital assets, the perception of value is evolving. In 2025, surveys indicate that over 60% of Japanese youth view NFTs as a legitimate form of ownership, which is likely to drive demand for digital collectibles. This cultural acceptance is fostering a community of collectors who are eager to engage with the non fungible-tokens market. Additionally, the rise of social media platforms that promote NFT sharing and trading is enhancing visibility and accessibility. As these cultural dynamics continue to evolve, they may lead to a broader acceptance of NFTs across various demographics, further solidifying their place in the digital economy.