Increased Focus on Patient Safety

Patient safety has become a paramount concern within the healthcare sector in Japan, significantly influencing the medication management market. The emphasis on reducing medication errors and adverse drug reactions is prompting healthcare organizations to adopt more robust medication management systems. Recent statistics indicate that medication errors account for approximately 7% of hospital admissions in Japan, underscoring the need for improved safety protocols. Consequently, healthcare providers are investing in technologies that enhance medication tracking and monitoring, thereby fostering a safer environment for patients. This heightened focus on safety is likely to propel the medication management market forward.

Rising Chronic Disease Prevalence

The prevalence of chronic diseases in Japan is a significant driver for the medication management market. With conditions such as diabetes, hypertension, and cardiovascular diseases on the rise, the demand for effective medication management solutions is escalating. Reports suggest that nearly 30% of the Japanese population is living with at least one chronic condition, necessitating comprehensive medication management strategies. This growing patient population requires tailored medication regimens, which in turn drives the need for advanced management systems. As healthcare providers seek to improve patient outcomes, the medication management market is poised for substantial growth.

Growing Demand for Personalized Medicine

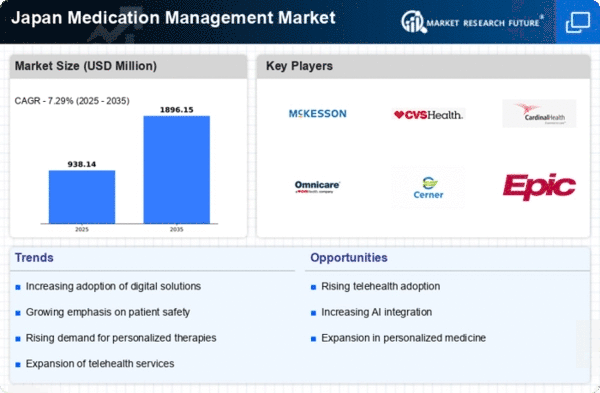

The shift towards personalized medicine is emerging as a critical driver in the medication management market. As healthcare in Japan evolves, there is an increasing recognition of the need for tailored treatment plans that consider individual patient characteristics. This trend is supported by advancements in pharmacogenomics, which enable healthcare providers to customize medication regimens based on genetic profiles. The market for personalized medicine is projected to grow at a CAGR of 15% over the next five years, indicating a robust demand for innovative medication management solutions. This growing emphasis on personalized approaches is likely to reshape the landscape of the medication management market.

Technological Advancements in Healthcare

The medication management market in Japan is experiencing a notable transformation due to rapid technological advancements. Innovations such as electronic health records (EHRs) and telemedicine platforms are enhancing the efficiency of medication management. These technologies facilitate better communication between healthcare providers and patients, leading to improved adherence to prescribed therapies. According to recent data, the adoption of EHRs in Japan has increased by approximately 30% over the past few years, indicating a shift towards more integrated healthcare solutions. This trend is likely to continue, as healthcare stakeholders increasingly recognize the value of technology in optimizing medication management processes.

Government Initiatives for Healthcare Improvement

The Japanese government is actively promoting initiatives aimed at enhancing healthcare quality, directly impacting the medication management market. Policies that encourage the integration of advanced technologies and support for innovative healthcare solutions are gaining traction. For instance, the government has allocated substantial funding to improve healthcare infrastructure, with a focus on medication management systems. This investment is expected to reach approximately ¥500 billion by 2026, reflecting the government's commitment to improving patient care. Such initiatives are likely to stimulate growth in the medication management market as healthcare providers adopt new technologies to comply with regulatory standards.