E-commerce Expansion and Cross-Border Trade

The expansion of e-commerce and cross-border trade in Japan is a significant driver for the language translation-software market. As online shopping continues to gain traction, businesses are increasingly looking to reach international customers. In 2025, the e-commerce sector in Japan is expected to grow by over 20%, necessitating effective communication with diverse consumer bases. This trend compels companies to adopt translation software to localize their content and enhance user experience. The language translation-software market is likely to see a surge in demand as businesses recognize the importance of providing multilingual support to cater to a global audience, thereby facilitating smoother transactions and customer satisfaction.

Rising Demand for Multilingual Communication

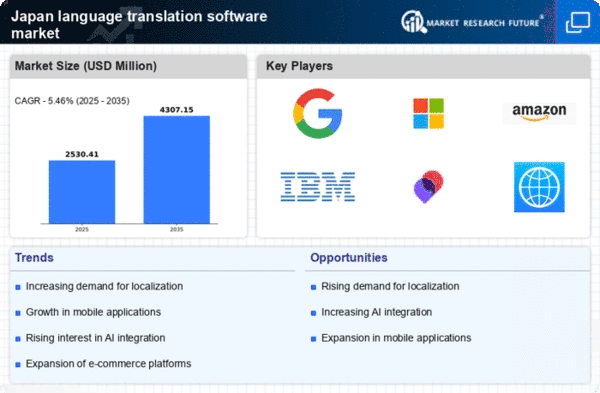

The increasing globalization of businesses in Japan drives the demand for effective multilingual communication. As companies expand their reach, the need for language translation-software becomes paramount. In 2025, the language translation-software market in Japan is projected to grow by approximately 15%, reflecting the necessity for seamless communication across diverse languages. This growth is fueled by the influx of foreign investments and the expansion of Japanese companies into international markets. Consequently, businesses are increasingly adopting translation software to enhance their customer engagement and operational efficiency. The language translation-software market is thus positioned to benefit from this trend, as organizations seek to bridge language barriers and foster collaboration in a multicultural environment.

Technological Advancements in Machine Learning

Technological advancements in machine learning are significantly impacting the language translation-software market. In Japan, the integration of sophisticated algorithms and neural networks enhances the accuracy and efficiency of translation services. As of November 2025, the market is witnessing a surge in demand for AI-driven translation tools, which are capable of learning from user interactions and improving over time. This evolution in technology not only streamlines the translation process but also reduces costs for businesses. The language translation-software market is likely to see a substantial increase in adoption rates as organizations recognize the value of these advanced solutions in providing high-quality translations that meet the needs of diverse audiences.

Increased Internet Penetration and Mobile Usage

The rapid increase in internet penetration and mobile device usage in Japan is a key driver for the language translation-software market. As of November 2025, approximately 95% of the population has access to the internet, with a significant portion utilizing mobile devices for communication and information retrieval. This trend creates a fertile ground for the adoption of translation software, particularly mobile applications that facilitate real-time translation. The language translation-software market is poised to capitalize on this growth, as users seek convenient and accessible solutions for overcoming language barriers in their daily interactions. The proliferation of mobile technology is thus a critical factor in shaping the future landscape of translation services.

Government Initiatives Supporting Language Learning

Government initiatives in Japan aimed at promoting language learning are contributing to the growth of the language translation-software market. Programs designed to enhance English proficiency and other foreign languages are encouraging individuals and businesses to seek translation solutions. As of November 2025, the government has allocated substantial funding to educational institutions to integrate technology into language learning, which indirectly boosts the demand for translation software. The language translation-software market stands to benefit from this supportive environment, as more individuals become aware of the importance of language skills in a globalized economy. This trend may lead to increased investments in translation technologies, further driving market growth.