Growing Regulatory Pressures

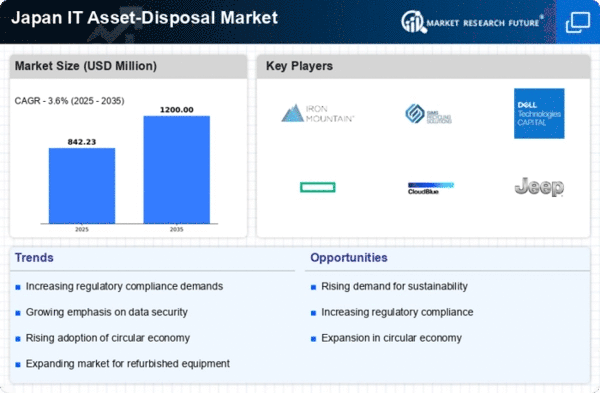

the market in Japan is influenced by growing regulatory pressures aimed at ensuring responsible disposal of electronic waste. The government has implemented stringent regulations that mandate proper recycling and disposal of IT assets. In 2025, compliance with these regulations is expected to be a critical factor for businesses, as non-compliance could result in substantial fines. This regulatory landscape compels organizations to partner with certified disposal companies that adhere to legal requirements. Consequently, the demand for compliant disposal services is likely to surge, driving growth in the it asset-disposition market. Companies that proactively address these regulatory challenges may gain a competitive edge by demonstrating their commitment to responsible asset management.

Shift Towards Circular Economy Models

the market in Japan is increasingly aligning with circular economy models, which emphasize the reuse and recycling of IT assets. This shift is driven by a growing recognition of the environmental impact of electronic waste. In 2025, it is projected that 60% of organizations will adopt circular economy principles in their asset management strategies. By focusing on refurbishment and resale, companies can extend the lifecycle of their IT assets while minimizing waste. This trend not only supports sustainability goals but also presents economic opportunities within the it asset-disposition market. As businesses seek to optimize resource utilization, the adoption of circular economy models is likely to reshape industry practices and drive innovation.

Rising Demand for Sustainable Practices

the market in Japan is experiencing a notable shift towards sustainable practices. As environmental awareness increases, businesses are compelled to adopt eco-friendly disposal methods. This trend is driven by stringent regulations aimed at reducing electronic waste. In 2025, Japan's electronic waste recycling rate is projected to reach 50%, reflecting a growing commitment to sustainability. Companies are increasingly seeking certified disposal partners to ensure compliance with environmental standards. This rising demand for sustainable practices not only enhances corporate responsibility but also opens new avenues for innovation within the it asset-disposition market. The integration of sustainable practices is likely to become a competitive differentiator, influencing purchasing decisions and partnerships in the industry.

Increased Awareness of Data Security Risks

In Japan, the it asset-disposition market is witnessing increased awareness of data security risks associated with improper disposal of IT assets. Organizations are becoming more cognizant of the potential repercussions of data breaches, leading to a heightened focus on secure disposal methods. In 2025, it is anticipated that 80% of companies will prioritize data security in their asset-disposition strategies. This trend is prompting businesses to invest in certified disposal services that guarantee data protection. As a result, the it asset-disposition market is likely to see a surge in demand for secure data destruction solutions. This heightened awareness not only influences purchasing decisions but also shapes the overall landscape of the industry.

Technological Advancements in Asset Recovery

Technological advancements are significantly shaping the it asset-disposition market in Japan. Innovations in data wiping and asset recovery technologies are enhancing the efficiency of the disposal process. In 2025, it is estimated that 70% of organizations will utilize advanced software solutions for secure data erasure, ensuring compliance with data protection regulations. These technologies not only mitigate risks associated with data breaches but also maximize the recovery value of disposed assets. As organizations increasingly recognize the importance of effective asset recovery, the demand for sophisticated solutions is likely to rise. This trend indicates a shift towards a more technology-driven approach in the it asset-disposition market, where efficiency and security are paramount.