Growing Need for Scalability and Flexibility

The integration platform-as-a-service market in Japan is increasingly driven by the need for scalability and flexibility among businesses. As organizations expand and evolve, their integration requirements become more complex, necessitating solutions that can adapt to changing demands. Companies are seeking platforms that not only facilitate integration but also allow for easy scaling of operations without significant overhead costs. This trend is particularly relevant for small and medium-sized enterprises (SMEs) in Japan, which are looking for cost-effective solutions that can grow with them. The market is likely to see a rise in offerings that emphasize modularity and customization, catering to the diverse needs of Japanese businesses. This focus on scalability could potentially lead to a market growth rate of around 18% in the coming years.

Increased Focus on Data Security and Privacy

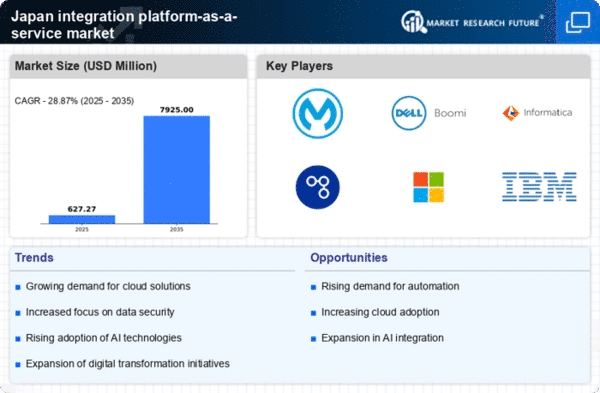

As data breaches and cyber threats become more prevalent, the integration platform-as-a-service market in Japan is witnessing an increased focus on data security and privacy. Organizations are prioritizing the protection of sensitive information, particularly in industries such as healthcare and finance, where compliance with regulations is critical. This heightened awareness is driving demand for integration solutions that incorporate advanced security features, such as encryption and access controls. Furthermore, the Japanese government has implemented stricter data protection laws, compelling businesses to adopt more secure integration practices. Consequently, the integration platform-as-a-service market is expected to evolve, with providers enhancing their security offerings to meet regulatory requirements and customer expectations. This trend may contribute to a projected market growth of approximately 12% over the next few years.

Rising Demand for Real-Time Data Integration

The integration platform-as-a-service market in Japan is experiencing a notable surge in demand for real-time data integration solutions. As businesses increasingly rely on data-driven decision-making, the need for seamless and instantaneous data flow between applications becomes paramount. This trend is particularly evident in sectors such as finance and retail, where timely access to information can significantly impact operational efficiency and customer satisfaction. According to recent estimates, the market for real-time data integration solutions is projected to grow at a CAGR of approximately 15% over the next five years. This growth is likely to drive innovation within the integration platform-as-a-service market, as providers enhance their offerings to meet the evolving needs of Japanese enterprises.

Expansion of Digital Transformation Initiatives

In Japan, the ongoing digital transformation initiatives across various industries are acting as a catalyst for the integration platform-as-a-service market. Organizations are increasingly adopting digital technologies to streamline operations, enhance customer experiences, and improve overall efficiency. This shift necessitates robust integration solutions that can connect disparate systems and applications. The Japanese government has also been promoting digital transformation through various initiatives, which further fuels the demand for integration services. As a result, the integration platform-as-a-service market is projected to witness substantial growth, with projections indicating a potential increase in market size by over 20% in the next few years. This trend underscores the critical role of integration solutions in supporting Japan's digital economy.

Emergence of Artificial Intelligence and Automation

the integration platform-as-a-service market in Japan is significantly influenced by the emergence of artificial intelligence (AI) and automation technologies. Businesses are increasingly leveraging AI to enhance their integration processes, enabling smarter data handling and improved operational efficiency. Automation tools are also being integrated into platforms to streamline workflows and reduce manual intervention. This trend is particularly beneficial for industries such as manufacturing and logistics, where efficiency is paramount. As AI and automation technologies continue to advance, the integration platform-as-a-service market is likely to see a surge in demand for intelligent integration solutions. Projections suggest that this segment could experience a growth rate of around 14% in the coming years, reflecting the transformative impact of these technologies on the market.