Urbanization and Population Growth

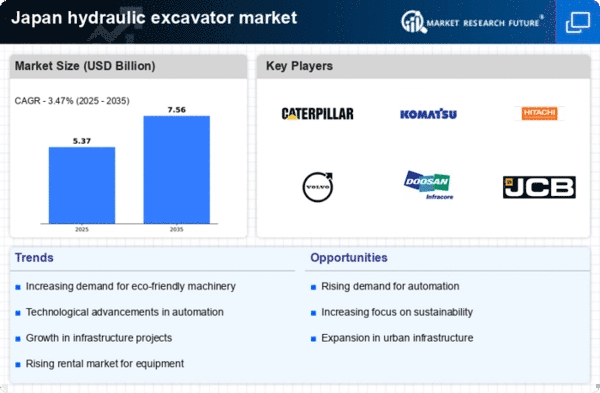

Japan's rapid urbanization and population growth are key drivers of the hydraulic excavator market. As urban areas expand, the need for residential, commercial, and industrial construction increases, leading to a higher demand for excavation services. The population density in metropolitan areas necessitates efficient land use, which often involves significant excavation work. In 2025, urban areas are projected to account for over 80% of Japan's total population, further intensifying the demand for hydraulic excavators. This trend suggests that construction companies will require more excavators to meet the growing needs of urban development, thereby propelling the hydraulic excavator market forward. The market is expected to see a compound annual growth rate (CAGR) of around 4% as urbanization continues to shape the construction landscape.

Infrastructure Development Initiatives

The hydraulic excavator market in Japan is experiencing a boost due to ongoing infrastructure development initiatives. The government has allocated substantial budgets for public works, including road construction, bridge repairs, and urban development projects. In 2025, the Japanese government announced a ¥10 trillion investment plan aimed at enhancing infrastructure resilience and sustainability. This investment is likely to increase the demand for hydraulic excavators, as they are essential for excavation, grading, and site preparation. The hydraulic excavator market is expected to grow by approximately 5% annually as these projects progress, indicating a robust demand for advanced machinery capable of meeting the rigorous requirements of modern construction. As a result, manufacturers are focusing on producing more efficient and technologically advanced excavators to cater to this growing market need.

Rising Demand for Eco-Friendly Equipment

The hydraulic excavator market is witnessing a rising demand for eco-friendly equipment as environmental concerns gain prominence in Japan. The government and construction companies are increasingly prioritizing sustainability, leading to a shift towards hydraulic excavators that utilize cleaner technologies. Electric and hybrid excavators are becoming more prevalent, as they offer reduced emissions and lower noise levels, making them suitable for urban environments. By 2025, it is projected that the market share of eco-friendly hydraulic excavators will reach 25%, reflecting a growing preference for sustainable construction practices. This trend indicates that manufacturers are likely to invest in research and development to produce more environmentally friendly models, thereby shaping the future of the hydraulic excavator market.

Technological Integration in Construction

The integration of advanced technologies in construction processes is significantly influencing the hydraulic excavator market. Innovations such as telematics, automation, and machine learning are being increasingly adopted in Japan's construction sector. These technologies enhance operational efficiency, reduce downtime, and improve safety on job sites. For instance, telematics systems allow for real-time monitoring of equipment performance, which can lead to better maintenance practices and reduced operational costs. As of 2025, it is estimated that around 30% of hydraulic excavators in Japan are equipped with such advanced technologies. This trend is likely to continue, driving demand for modern hydraulic excavators that can support these technological advancements, thereby shaping the future landscape of the hydraulic excavator market.

Government Regulations and Safety Standards

The hydraulic excavator market is also influenced by stringent government regulations and safety standards in Japan. The Ministry of Land, Infrastructure, Transport and Tourism has implemented various regulations aimed at ensuring safety and environmental protection in construction activities. Compliance with these regulations often necessitates the use of advanced hydraulic excavators that meet specific safety and emission standards. As of 2025, it is estimated that approximately 60% of construction companies are investing in newer, compliant machinery to adhere to these regulations. This shift is likely to drive the demand for hydraulic excavators that not only fulfill operational requirements but also align with regulatory standards, thereby fostering growth in the hydraulic excavator market.