Innovation in Snack Products

Innovation within the snack product category is a crucial driver for the japan healthy snacks market. Companies are continuously exploring new flavors, textures, and ingredients to attract health-conscious consumers. For instance, the introduction of snacks made from alternative ingredients such as quinoa, chickpeas, and seaweed has gained traction in recent years. Market data indicates that the demand for innovative snacks has increased by approximately 25 percent over the past year. This trend suggests that consumers are not only looking for healthier options but also for unique and exciting flavors. As a result, the japan healthy snacks market is witnessing a surge in product launches that emphasize creativity and health benefits, catering to the evolving preferences of consumers.

Growing Demand for Convenience Foods

The growing demand for convenience foods is reshaping the landscape of the japan healthy snacks market. Busy lifestyles and the increasing number of working professionals have led to a preference for on-the-go snack options that do not compromise on health. Recent studies indicate that around 70 percent of Japanese consumers seek snacks that are easy to carry and consume. This trend has prompted manufacturers to develop portable and ready-to-eat healthy snacks, such as protein bars and single-serving packs of nuts. The japan healthy snacks market is likely to continue evolving in response to this demand, as companies strive to create convenient yet nutritious products that cater to the fast-paced lives of consumers.

Health Consciousness Among Consumers

The increasing health consciousness among consumers in Japan appears to be a primary driver of the japan healthy snacks market. As individuals become more aware of the impact of diet on overall health, there is a noticeable shift towards healthier snack options. According to recent surveys, approximately 60 percent of Japanese consumers prioritize health benefits when selecting snacks. This trend is likely to continue, as the demand for low-calorie, low-sugar, and nutrient-dense snacks grows. The japan healthy snacks market is responding by introducing a variety of products that cater to these preferences, including snacks fortified with vitamins and minerals. Furthermore, the rise of social media and health influencers has amplified this trend, encouraging consumers to make informed choices about their snacking habits.

Rise of E-commerce and Online Shopping

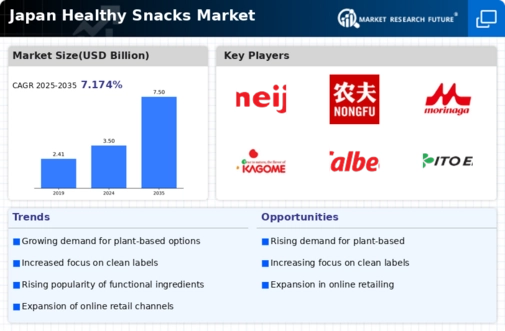

The rise of e-commerce and online shopping is transforming the distribution channels within the japan healthy snacks market. With the increasing penetration of the internet and mobile devices, consumers are increasingly turning to online platforms to purchase their snacks. Recent data suggests that online sales of healthy snacks have surged by over 30 percent in the past year. This shift not only provides consumers with greater access to a wider variety of products but also allows for the convenience of home delivery. As a result, manufacturers and retailers are investing in their online presence to capture this growing segment of the market. The japan healthy snacks market is likely to see continued growth as e-commerce becomes an integral part of the shopping experience for health-conscious consumers.

Government Initiatives Promoting Healthy Eating

Government initiatives aimed at promoting healthy eating habits are significantly influencing the japan healthy snacks market. The Japanese government has implemented various policies to encourage healthier lifestyles, including the Basic Act on Food Education, which aims to improve dietary habits among citizens. These initiatives often include educational campaigns that highlight the importance of nutrition and the benefits of consuming healthy snacks. As a result, manufacturers are increasingly aligning their product offerings with these government guidelines, leading to a rise in the availability of nutritious snack options. The japan healthy snacks market is likely to benefit from these initiatives, as they create a favorable environment for the growth of health-oriented products.