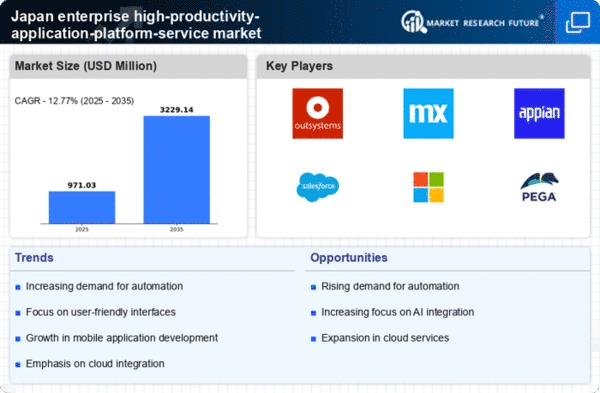

The enterprise high-productivity-application-platform-service market in Japan is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for digital transformation. Key players such as OutSystems (PT), Mendix (NL), and Appian (US) are strategically positioned to leverage their innovative capabilities and robust service offerings. OutSystems (PT) focuses on enhancing its low-code development platform, aiming to simplify application development processes, while Mendix (NL) emphasizes its strong integration capabilities with existing enterprise systems. Appian (US) is concentrating on expanding its automation features, which aligns with the growing trend towards operational efficiency. Collectively, these strategies foster a competitive environment that encourages continuous innovation and responsiveness to market needs.

In terms of business tactics, companies are increasingly localizing their operations to better serve the Japanese market, optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive structure allows for a diverse range of solutions, catering to various enterprise needs while fostering a culture of innovation.

In October 2025, OutSystems (PT) announced a strategic partnership with a leading Japanese telecommunications company to enhance its service delivery capabilities. This collaboration is expected to facilitate the integration of advanced cloud services, thereby improving application performance and scalability for local enterprises. Such partnerships are crucial as they not only expand market reach but also enhance the technological capabilities of the platform, positioning OutSystems favorably against competitors.

In September 2025, Mendix (NL) launched a new initiative aimed at promoting sustainability within its application development processes. This initiative focuses on reducing the carbon footprint of applications developed on its platform, aligning with global sustainability trends. By prioritizing eco-friendly practices, Mendix is likely to attract environmentally conscious enterprises, thereby differentiating itself in a crowded market.

In August 2025, Appian (US) unveiled a significant upgrade to its automation suite, incorporating advanced AI capabilities to streamline business processes. This enhancement is particularly relevant as enterprises increasingly seek to leverage AI for operational efficiency. The integration of AI not only improves the functionality of Appian's offerings but also positions the company as a leader in the automation space, potentially increasing its market share.

As of November 2025, the competitive trends in the enterprise high-productivity-application-platform-service market are heavily influenced by digitalization, sustainability, and AI integration. Strategic alliances are becoming increasingly important, as they enable companies to pool resources and expertise, thereby enhancing their competitive edge. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based strategies to a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies that prioritize these areas are likely to thrive in an increasingly competitive landscape.

Leave a Comment