Emergence of Green Data Centers

Sustainability is becoming a pivotal driver in the Japan data center market, with an increasing number of facilities adopting green practices. The push for energy-efficient operations is fueled by both regulatory pressures and corporate social responsibility initiatives. Data centers are exploring renewable energy sources, such as solar and wind, to reduce their carbon footprint. According to recent reports, the energy consumption of data centers in Japan is projected to rise, necessitating the adoption of sustainable practices. The emergence of green data centers not only aligns with global sustainability goals but also appeals to environmentally conscious clients. This trend is likely to shape the future of the Japan data center market, as organizations prioritize eco-friendly solutions in their operational strategies.

Increased Focus on Data Security

In the Japan data center market, there is an escalating emphasis on data security and compliance. With the rise of cyber threats and data breaches, organizations are prioritizing the protection of sensitive information. The implementation of stringent regulations, such as the Act on the Protection of Personal Information, has heightened awareness regarding data security. As a result, data centers are investing in advanced security measures, including encryption and multi-factor authentication, to safeguard client data. This focus on security not only enhances customer trust but also drives the demand for secure data center solutions. The evolving regulatory landscape is likely to continue influencing the operational strategies within the Japan data center market.

Rising Demand for Cloud Services

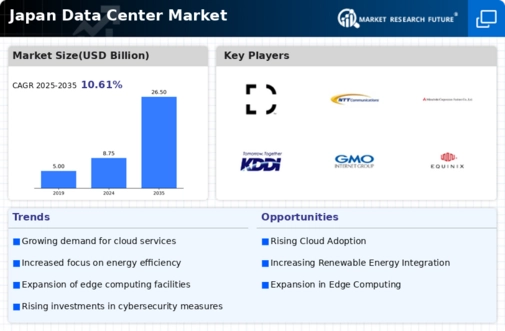

The Japan data center market is experiencing a notable surge in demand for cloud services. As businesses increasingly migrate to cloud-based solutions, the need for robust data center infrastructure intensifies. According to recent statistics, the cloud computing market in Japan is projected to reach approximately 3 trillion yen by 2025. This growth is driven by enterprises seeking scalability, flexibility, and cost-efficiency. Consequently, data centers are evolving to accommodate this demand, leading to enhanced service offerings and improved operational efficiencies. The shift towards cloud services is likely to continue shaping the landscape of the Japan data center market, as organizations prioritize digital transformation and seek reliable partners for their cloud strategies.

Government Initiatives and Investments

The Japan data center market benefits from various government initiatives aimed at promoting digital infrastructure. The Japanese government has recognized the importance of data centers in supporting economic growth and technological advancement. Initiatives such as the "Society 5.0" vision emphasize the integration of advanced technologies, including AI and IoT, into everyday life. Investments in data center infrastructure are expected to increase, with the government allocating funds to enhance connectivity and energy efficiency. This proactive approach not only fosters innovation but also positions Japan as a competitive player in The japan data center market. The collaboration between public and private sectors is likely to yield significant advancements in data center capabilities.

Growth of Artificial Intelligence and Big Data

The integration of artificial intelligence (AI) and big data analytics is transforming the Japan data center market. Organizations are increasingly leveraging these technologies to derive insights from vast amounts of data, leading to improved decision-making and operational efficiencies. The demand for data processing capabilities is expected to rise, prompting data centers to enhance their infrastructure to support AI workloads. According to industry forecasts, the AI market in Japan is anticipated to grow significantly, potentially reaching 1 trillion yen by 2025. This growth is likely to drive investments in data center technologies, as businesses seek to harness the power of AI and big data for competitive advantage. The synergy between AI and data centers is poised to redefine the operational landscape of the Japan data center market.