Growing Demand for LNG

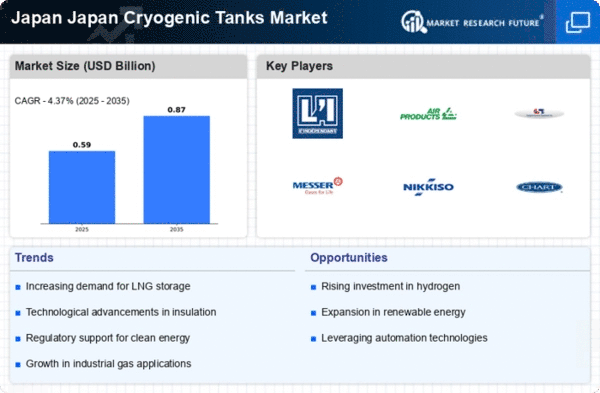

The Japan Cryogenic Tanks Market is experiencing a notable increase in demand for liquefied natural gas (LNG). As Japan continues to transition towards cleaner energy sources, LNG has emerged as a preferred alternative to traditional fossil fuels. The government has implemented policies to promote LNG usage, which has led to a surge in infrastructure development for LNG storage and transportation. In 2025, Japan's LNG imports reached approximately 80 million tons, indicating a robust market for cryogenic tanks. This trend is likely to persist as Japan aims to reduce its carbon footprint and enhance energy security, thereby driving the growth of the cryogenic tanks market.

Rising Industrial Applications

The Japan Cryogenic Tanks Market is witnessing a surge in industrial applications, particularly in sectors such as healthcare, aerospace, and food processing. The demand for cryogenic tanks in the medical field, especially for the storage of vaccines and biological samples, is increasing. In 2025, the healthcare sector accounted for approximately 15% of the total cryogenic tank market share in Japan. Furthermore, the aerospace industry is utilizing cryogenic technology for rocket fuel storage, which is expected to grow as Japan enhances its space exploration initiatives. This diversification of applications is likely to drive the demand for cryogenic tanks in the coming years.

Advancements in Cryogenic Technology

Technological innovations in cryogenic storage systems are significantly influencing the Japan Cryogenic Tanks Market. Recent advancements have led to the development of more efficient and safer cryogenic tanks, which are essential for the storage of liquefied gases. For instance, the introduction of advanced insulation materials and monitoring systems has improved the performance and reliability of cryogenic tanks. As of January 2026, the market is witnessing a shift towards smart cryogenic tanks equipped with IoT capabilities, allowing for real-time monitoring and management. This technological evolution is expected to enhance operational efficiency and safety, thereby attracting investments in the cryogenic tanks sector.

Regulatory Support and Policy Framework

The Japan Cryogenic Tanks Market is supported by a robust regulatory framework that encourages the safe and efficient use of cryogenic technologies. The government has established stringent safety standards and guidelines for the design and operation of cryogenic tanks, ensuring high levels of safety and reliability. Additionally, policies promoting the use of LNG and hydrogen as clean energy sources are likely to bolster market growth. As of January 2026, the government is actively working on enhancing regulations to facilitate the expansion of cryogenic storage facilities, which is expected to create a favorable environment for market players.

Increased Investment in Renewable Energy

The Japan Cryogenic Tanks Market is benefiting from increased investments in renewable energy projects. The government has set ambitious targets for renewable energy generation, aiming for 50% of the energy mix by 2030. This shift necessitates the development of efficient energy storage solutions, including cryogenic tanks for storing liquefied gases produced from renewable sources. In 2025, investments in renewable energy projects in Japan exceeded 20 billion USD, indicating a strong commitment to sustainable energy. As these projects proliferate, the demand for cryogenic tanks is likely to rise, further propelling market growth.