Labor Shortages and Skill Gaps

Japan's construction industry is currently facing significant labor shortages, exacerbated by an aging workforce and declining birth rates. This situation compels construction firms to seek alternative solutions, such as the rental of equipment, to maintain productivity levels. The construction equipment-rental market is positioned to thrive as companies opt for rental services to mitigate the impact of labor shortages. By utilizing rental equipment, firms can quickly adapt to project demands without the need for extensive training or hiring of skilled labor. This trend suggests a shift towards a more flexible operational model, where the rental market plays a crucial role in sustaining construction activities amid workforce challenges.

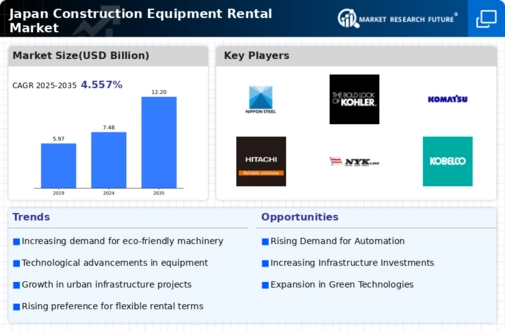

Rising Infrastructure Investments

The construction equipment-rental market in Japan is experiencing a notable boost due to increased investments in infrastructure projects. The Japanese government has allocated substantial budgets for the development of transportation networks, urban facilities, and public utilities. For instance, the 2025 budget includes an estimated ¥6 trillion for infrastructure improvements, which is expected to drive demand for rental equipment. This trend indicates a growing reliance on rental services, as companies seek to minimize capital expenditures while maximizing operational efficiency. Consequently, the construction equipment-rental market is likely to benefit from this influx of projects, as contractors prefer renting over purchasing to maintain flexibility and reduce financial risks.

Environmental Regulations and Compliance

The construction equipment-rental market is increasingly influenced by stringent environmental regulations in Japan. As the government enforces stricter emissions standards and sustainability practices, construction companies are compelled to adopt greener technologies. Renting equipment that meets these regulations allows firms to comply without the burden of significant capital investment. The market is witnessing a rise in demand for eco-friendly machinery, which aligns with the government's commitment to reducing carbon emissions by 26% by 2030. This regulatory landscape indicates that the construction equipment-rental market will likely expand as companies seek to enhance their environmental performance while managing costs effectively.

Economic Recovery and Construction Demand

Japan's economic recovery is positively impacting the construction equipment-rental market. As the economy shows signs of growth, construction activities are expected to increase, driven by both public and private sector investments. The construction sector's contribution to GDP is projected to rise by 2.5% in 2025, leading to heightened demand for rental equipment. Companies are likely to prefer renting over purchasing to maintain financial flexibility during this recovery phase. This economic landscape indicates that the construction equipment-rental market is poised for growth, as businesses seek to capitalize on emerging opportunities while managing their capital expenditures.

Technological Integration in Rental Services

The integration of advanced technologies in the construction equipment-rental market is transforming how rental services operate in Japan. Innovations such as telematics, GPS tracking, and mobile applications are enhancing equipment management and operational efficiency. These technologies enable rental companies to monitor equipment usage, optimize maintenance schedules, and improve customer service. As a result, construction firms are increasingly inclined to rent technologically advanced equipment, which can lead to higher productivity and reduced downtime. This trend suggests that the construction equipment-rental market will continue to evolve, driven by the demand for smarter, more efficient rental solutions.