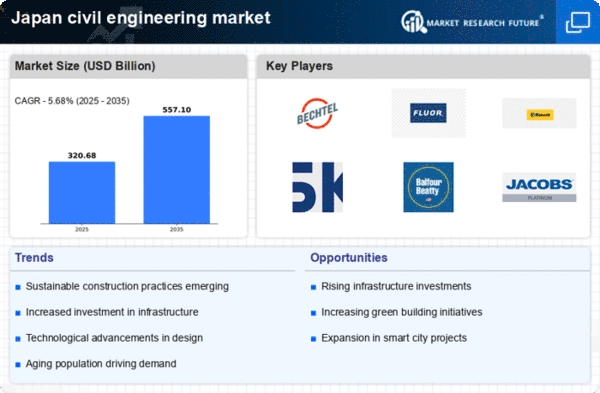

Government Infrastructure Policies

Government policies play a pivotal role in shaping the civil engineering market in Japan. The Japanese government has initiated various infrastructure development programs aimed at revitalizing the economy and improving public services. For instance, the 2020 fiscal budget allocated approximately ¥6 trillion for infrastructure projects, which is expected to stimulate growth in the civil engineering sector. These policies not only focus on new constructions but also on the maintenance and upgrading of existing infrastructure. The emphasis on public-private partnerships enhances investment opportunities. This indicates a favorable environment for civil engineering firms to thrive and innovate.

Urbanization and Population Growth

The rapid urbanization in Japan is a crucial driver for the civil engineering market. As urban areas expand, the demand for infrastructure such as roads, bridges, and public transport systems increases significantly. The population density in metropolitan regions, particularly in Tokyo, necessitates innovative engineering solutions to accommodate the growing populace. According to recent data, urban areas in Japan are projected to house over 90% of the population by 2030, which will likely lead to an increased investment in civil engineering projects. This trend indicates a robust growth trajectory for the civil engineering market, as municipalities seek to enhance urban infrastructure to support the needs of their residents.

Environmental Regulations and Compliance

The civil engineering market in Japan is increasingly influenced by stringent environmental regulations. As the nation strives to meet its sustainability goals, civil engineering projects must adhere to rigorous environmental standards. This includes minimizing ecological impact during construction and ensuring compliance with waste management protocols. The introduction of the Basic Act on Establishing a Sound Material-Cycle Society has prompted civil engineering firms to adopt innovative practices that align with environmental sustainability. Consequently, this regulatory landscape may drive demand for specialized engineering services that focus on eco-friendly construction methods, thereby shaping the future of the civil engineering market.

Technological Integration in Construction

The integration of advanced technologies is transforming the civil engineering market in Japan. Innovations such as Building Information Modeling (BIM), drones, and artificial intelligence are enhancing project efficiency and accuracy. These technologies facilitate better planning, monitoring, and management of construction projects, leading to reduced costs and improved timelines. The Japanese government has been promoting the adoption of these technologies through various initiatives, which could potentially increase productivity in the civil engineering sector. As firms embrace digital transformation, the civil engineering market is likely to witness a paradigm shift, fostering a competitive edge in project delivery and execution.

Aging Infrastructure and Rehabilitation Needs

Japan's aging infrastructure presents both challenges and opportunities for the civil engineering market. Many structures, including bridges and roads, are reaching the end of their operational lifespan, necessitating extensive rehabilitation and retrofitting efforts. The Ministry of Land, Infrastructure, Transport and Tourism has reported that over 50% of bridges in Japan are over 50 years old, highlighting the urgent need for modernization. This situation creates a substantial demand for civil engineering services focused on infrastructure assessment, repair, and enhancement. As the government prioritizes safety and functionality, the civil engineering market is likely to experience growth driven by rehabilitation projects.