Rising Electronics Manufacturing

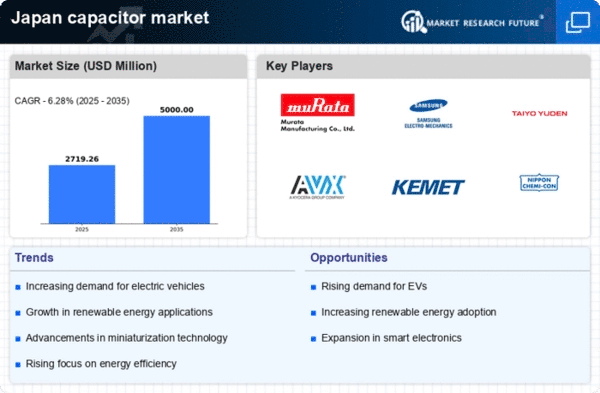

The capacitor market in Japan is experiencing a notable surge due to the increasing demand for electronic devices. Japan's electronics manufacturing sector, which includes smartphones, laptops, and consumer electronics, is projected to grow at a CAGR of approximately 5% over the next few years. This growth is likely to drive the demand for capacitors, as they are essential components in electronic circuits. The capacitor market is expected to benefit from this trend, with manufacturers focusing on producing high-quality capacitors to meet the evolving needs of the electronics industry. Furthermore, the emphasis on miniaturization in electronic devices necessitates the development of smaller, more efficient capacitors, thereby enhancing the market's growth potential.

Expansion of Renewable Energy Sources

The capacitor market in Japan is poised for growth as the country expands its renewable energy sources. With a commitment to achieving carbon neutrality by 2050, Japan is investing heavily in solar and wind energy. Capacitors play a crucial role in energy storage systems, which are essential for managing the intermittent nature of renewable energy. The market for capacitors used in energy storage applications is expected to grow significantly, potentially reaching a value of $1 billion by 2027. This shift towards renewable energy not only supports the capacitor market but also aligns with Japan's broader sustainability goals, creating a favorable environment for capacitor manufacturers.

Increased Investment in Electric Vehicles

The capacitor market in Japan is likely to benefit from the rising investment in electric vehicles (EVs). As major automotive manufacturers shift their focus towards EV production, the demand for capacitors in automotive applications is expected to increase. Capacitors are vital for various functions in EVs, including energy storage and power management. The Japanese government has set ambitious targets for EV adoption, aiming for 100% of new vehicle sales to be electric by 2035. This transition is anticipated to create a robust demand for capacitors, thereby driving growth in the capacitor market. The automotive sector's evolution towards electrification presents a significant opportunity for capacitor manufacturers to innovate and expand their product offerings.

Technological Innovations in Capacitor Design

The capacitor market in Japan is witnessing advancements in capacitor design and technology. Innovations such as the development of supercapacitors and multilayer ceramic capacitors are enhancing performance and efficiency. These technological advancements are likely to cater to the growing needs of various industries, including telecommunications and consumer electronics. The market for advanced capacitors is projected to grow at a CAGR of around 6% through 2028, driven by the demand for higher energy density and faster charging capabilities. As manufacturers invest in research and development, the capacitor market is expected to evolve, offering new solutions that meet the stringent requirements of modern applications.

Government Policies Supporting Electronics and Energy Sectors

The capacitor market in Japan is influenced by government policies aimed at supporting the electronics and energy sectors. Initiatives such as subsidies for renewable energy projects and incentives for electric vehicle production are likely to stimulate demand for capacitors. The Japanese government has introduced various programs to promote innovation and sustainability, which could enhance the growth prospects of the capacitor market. Additionally, regulatory frameworks that encourage the adoption of energy-efficient technologies may further drive the demand for capacitors in various applications. As these policies take effect, they are expected to create a conducive environment for capacitor manufacturers to thrive.