Growth of IoT Devices

The proliferation of Internet of Things (IoT) devices in Japan is a crucial driver for the big data market. With millions of connected devices generating vast amounts of data, the need for effective data management and analysis is more pressing than ever. In 2025, it is estimated that the number of IoT devices in Japan will exceed 1 billion, contributing significantly to the data landscape. This surge in data generation presents both challenges and opportunities for businesses. Companies are increasingly adopting big data solutions to process and analyze the data collected from IoT devices, enabling them to gain insights into consumer behavior and operational efficiency. Consequently, the big data market is poised for growth as organizations seek to capitalize on the insights derived from IoT data.

Increased Focus on Data Security

The heightened focus on data security in Japan is a significant driver for the big data market. As organizations collect and analyze more data, concerns regarding data breaches and privacy violations have intensified. In 2025, it is estimated that spending on data security solutions will reach $1 billion, reflecting the urgent need for robust security measures. Companies are investing in advanced security technologies to protect sensitive information and comply with regulatory requirements. This emphasis on data security not only safeguards organizational assets but also builds consumer trust. As a result, the big data market is likely to see increased demand for security-focused solutions, enabling businesses to harness the power of data while mitigating risks associated with data management.

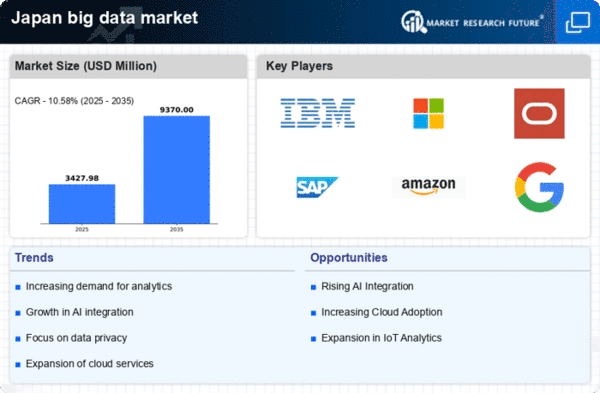

Rising Demand for Data Analytics

The increasing demand for data analytics in Japan is a pivotal driver for the big data market. Organizations across various sectors are recognizing the value of data-driven decision-making. In 2025, the analytics segment is projected to account for approximately 30% of the overall big data market revenue in Japan. This trend is fueled by the need for businesses to enhance operational efficiency and improve customer experiences. As companies strive to remain competitive, they are investing in advanced analytics tools and platforms. The integration of analytics into business processes is expected to lead to more informed strategies and better resource allocation. Consequently, is likely to experience substantial growth as organizations seek to harness the power of data analytics to drive innovation and profitability.

Government Initiatives and Support

Government initiatives in Japan are significantly influencing the big data market. The Japanese government has been actively promoting the use of big data technologies to enhance public services and stimulate economic growth. In 2025, government funding for big data projects is anticipated to reach around $500 million, aimed at fostering innovation and collaboration between public and private sectors. These initiatives include the establishment of data-sharing platforms and the development of regulatory frameworks that encourage data utilization while ensuring privacy and security. As a result, the big data market is likely to benefit from increased investment and support, leading to the emergence of new applications and services that leverage data for societal advancement.

Emergence of Advanced Data Technologies

The emergence of advanced data technologies is reshaping the landscape of the big data market in Japan. Innovations such as real-time data processing, edge computing, and enhanced data storage solutions are becoming increasingly prevalent. These technologies enable organizations to handle large volumes of data more efficiently and derive insights in real-time. In 2025, the market for advanced data technologies is projected to grow by approximately 25%, driven by the need for faster and more reliable data processing capabilities. As businesses seek to leverage these technologies, the big data market is likely to expand, offering new opportunities for vendors and service providers to deliver cutting-edge solutions that meet the evolving demands of data-driven enterprises.