Growing Awareness of Cyber Threats

There is a growing awareness of cyber threats within the smart grid-security market in Italy. As cyberattacks become more sophisticated, stakeholders are increasingly recognizing the vulnerabilities inherent in smart grid systems. This heightened awareness is prompting utilities and energy providers to prioritize cybersecurity investments. Surveys indicate that approximately 70% of energy companies in Italy consider cybersecurity a top priority, reflecting a shift in mindset towards proactive security measures. This trend is likely to drive demand for advanced security solutions, as organizations seek to mitigate risks associated with cyber threats. The increasing recognition of the importance of cybersecurity is expected to significantly influence the strategic decisions made within the smart grid-security market.

Rising Demand for Energy Resilience

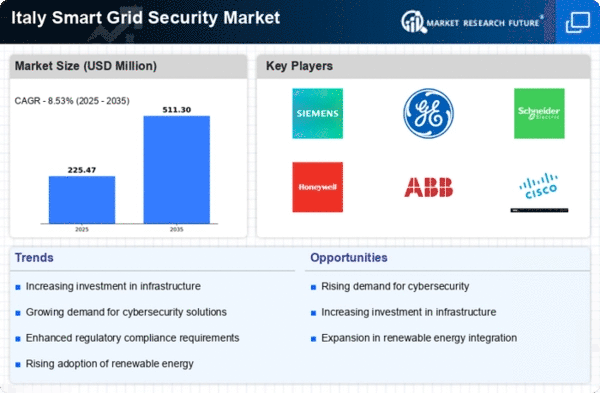

The smart grid-security market in Italy is experiencing a notable surge in demand for energy resilience. This trend is driven by the increasing frequency of extreme weather events and the need for reliable energy supply. As Italy's energy infrastructure becomes more interconnected, the potential for cyber threats escalates. Consequently, investments in smart grid-security solutions are projected to grow, with estimates suggesting a market value increase of approximately 15% annually. This heightened focus on resilience is prompting utilities to adopt advanced security measures, ensuring that energy systems can withstand both physical and cyber threats. The emphasis on energy resilience is likely to shape the strategic direction of the smart grid-security market, as stakeholders prioritize the protection of critical infrastructure.

Increased Regulatory Compliance Requirements

The smart grid-security market in Italy is being shaped by stringent regulatory compliance requirements. The Italian government, in alignment with European Union directives, is implementing robust regulations aimed at enhancing the security of energy infrastructure. These regulations mandate that utilities adopt comprehensive cybersecurity measures to protect against potential threats. As a result, companies are compelled to invest in advanced security solutions to ensure compliance, which is projected to contribute to a market growth rate of around 12% over the next few years. The focus on regulatory compliance not only drives investments in security technologies but also fosters a culture of accountability within the energy sector, ultimately enhancing the overall security posture of the smart grid.

Investment in Smart Infrastructure Development

Investment in smart infrastructure development is a key driver of the smart grid-security market in Italy. The transition towards smart grids necessitates the implementation of advanced technologies that enhance operational efficiency and security. As Italy invests in modernizing its energy infrastructure, the integration of smart technologies is becoming imperative. This shift is expected to lead to an estimated market growth of 10% annually, as utilities seek to leverage smart grid capabilities while ensuring robust security measures are in place. The focus on smart infrastructure not only enhances energy management but also necessitates the adoption of comprehensive security frameworks to protect against emerging threats. This dual focus on innovation and security is likely to define the future landscape of the smart grid-security market.

Technological Advancements in Security Solutions

Technological innovations are significantly influencing the smart grid-security market in Italy. The advent of artificial intelligence (AI) and machine learning (ML) is enhancing the capabilities of security solutions, enabling real-time threat detection and response. These advancements are crucial as they allow for the analysis of vast amounts of data generated by smart grid systems. Reports indicate that the integration of AI-driven security measures could reduce response times to cyber incidents by up to 30%. As utilities and energy providers seek to modernize their infrastructure, the adoption of these cutting-edge technologies is expected to drive growth in the smart grid-security market. The continuous evolution of security technologies will likely play a pivotal role in addressing emerging threats and vulnerabilities.