Aging Population

The demographic shift towards an aging population significantly influences the Global Italy Health and Wellness Product Market Industry. As the proportion of elderly individuals rises, there is an increasing demand for products that cater to their specific health needs. This demographic change is expected to drive market growth, as older adults often seek supplements, fitness programs, and wellness products that promote longevity and vitality. The market's expansion is likely to be further supported by innovations in product formulations tailored for this age group, thereby enhancing their quality of life and contributing to the projected market size of 541.32 USD Billion by 2035.

Sustainability Trends

Sustainability is becoming a pivotal factor in consumer purchasing decisions within the Global Italy Health and Wellness Product Market Industry. As environmental concerns grow, consumers are gravitating towards products that are ethically sourced and environmentally friendly. This trend is reflected in the rising popularity of organic and plant-based products, which not only promote health but also align with sustainable practices. Companies that prioritize sustainability are likely to gain a competitive edge, appealing to eco-conscious consumers. This shift may contribute to the overall market growth, as sustainability becomes a core value in health and wellness consumption.

Rising Health Awareness

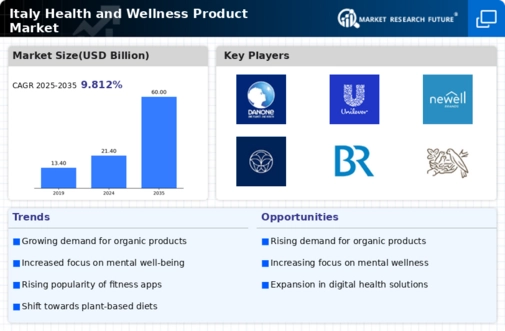

The Global Italy Health and Wellness Product Market Industry is experiencing a notable surge in consumer health consciousness. Individuals are increasingly prioritizing their well-being, leading to a growing demand for health-oriented products. This trend is evidenced by the projected market size of 235.94 USD Billion in 2024, reflecting a shift towards preventive healthcare. Consumers are actively seeking organic, natural, and functional products that promise enhanced health benefits. This heightened awareness is not merely a fleeting trend; it indicates a fundamental change in lifestyle choices, with consumers willing to invest in products that align with their health goals.

Increased Online Retailing

The rise of e-commerce is transforming the Global Italy Health and Wellness Product Market Industry, providing consumers with unprecedented access to a wide array of health products. Online platforms facilitate convenience and often offer a broader selection than traditional retail outlets. This trend is particularly appealing to younger consumers, who prefer the ease of online shopping. As a result, the market is expected to expand significantly, with online sales contributing to the overall growth trajectory. The shift towards digital retailing is likely to enhance market dynamics, making health and wellness products more accessible to a diverse consumer base.

Technological Advancements

Technological innovations are reshaping the Global Italy Health and Wellness Product Market Industry, providing consumers with enhanced access to health-related information and products. The integration of digital platforms, mobile applications, and wearable technology facilitates personalized health management, enabling consumers to track their wellness journeys effectively. This trend is likely to attract a younger demographic, who are more inclined to utilize technology for health monitoring. As a result, the market is expected to witness a compound annual growth rate of 7.84% from 2025 to 2035, driven by the increasing reliance on technology in health and wellness.