Expansion of 5G Networks

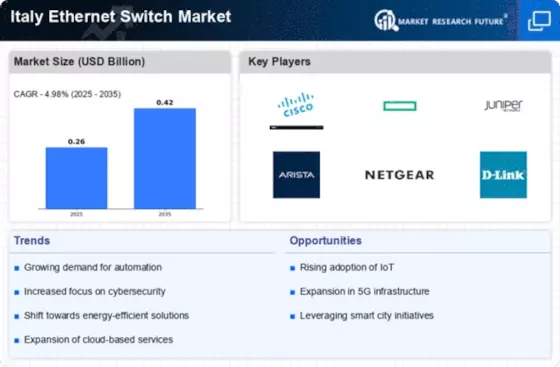

The rollout of 5G networks across Italy is significantly influencing the Ethernet switch market. With the government investing heavily in telecommunications infrastructure, the Italy Ethernet Switch Market is poised for growth as 5G technology requires high-performance switches to manage increased data traffic. The demand for Ethernet switches that can handle the high speeds and low latency associated with 5G is expected to rise. Reports indicate that the number of 5G subscriptions in Italy is anticipated to reach 20 million by 2026, further driving the need for advanced networking solutions that can support this technology.

Rising Cybersecurity Concerns

As cybersecurity threats continue to escalate, the demand for secure networking solutions is becoming increasingly critical in Italy. The Italy Ethernet Switch Market is responding to this need by offering switches with advanced security features. Organizations are prioritizing the implementation of Ethernet switches that provide enhanced security protocols to protect sensitive data. Recent statistics indicate that cyberattacks in Italy have increased by 30% over the past year, prompting businesses to invest in secure networking infrastructure. This trend is likely to drive the growth of the Ethernet switch market as companies seek to safeguard their networks against potential threats.

Increased Focus on Smart Cities

Italy's commitment to developing smart cities is creating new opportunities for the Ethernet switch market. The Italy Ethernet Switch Market is likely to benefit from investments in smart infrastructure, which relies on efficient networking solutions. As municipalities implement smart technologies for traffic management, public safety, and energy efficiency, the demand for Ethernet switches that can support these applications is expected to grow. The Italian government has allocated significant funding for smart city projects, which could lead to a substantial increase in the deployment of Ethernet switches in urban areas, enhancing connectivity and data management.

Growing Adoption of Cloud Services

The increasing adoption of cloud services in Italy is driving the demand for Ethernet switches. As businesses migrate to cloud-based solutions, the need for robust networking infrastructure becomes paramount. The Italy Ethernet Switch Market is witnessing a surge in demand for switches that can support high bandwidth and low latency, essential for cloud applications. According to recent data, the cloud services market in Italy is projected to grow at a compound annual growth rate (CAGR) of 20% over the next five years. This growth necessitates the deployment of advanced Ethernet switches to ensure seamless connectivity and data transfer, thereby enhancing operational efficiency for enterprises.

Government Initiatives and Regulations

The Italian government is actively promoting digital transformation through various initiatives and regulations, which is positively impacting the Ethernet switch market. The Italy Ethernet Switch Market is likely to see growth as policies aimed at enhancing digital infrastructure are implemented. For instance, the National Recovery and Resilience Plan (NRRP) includes provisions for upgrading telecommunications infrastructure, which encompasses the deployment of Ethernet switches. This governmental support is expected to stimulate investments in networking technologies, thereby driving the demand for Ethernet switches across various sectors, including education, healthcare, and manufacturing.