Increasing Health Awareness

The empty capsule market in Italy is growing due to increasing consumer awareness of health and wellness. As individuals become more conscious of their dietary choices, there is a notable shift towards supplements and nutraceuticals. This trend is reflected in the increasing demand for vegetarian and plant-based capsules, which are perceived as healthier alternatives. According to recent data, the Italian nutraceutical market is projected to reach approximately €3 billion by 2026, indicating a robust growth trajectory. This heightened focus on health is likely to propel the empty capsule market, as manufacturers adapt to consumer preferences for natural and organic products. Consequently, the empty capsule market is poised to benefit from this evolving consumer landscape, as companies innovate to meet the demand for health-oriented solutions.

Regulatory Support for Nutraceuticals

The empty capsule market in Italy is positively influenced by regulatory support for nutraceuticals and dietary supplements. The Italian government has implemented various policies aimed at promoting the growth of the nutraceutical sector, which in turn supports the empty capsule market. These regulations often focus on ensuring product safety, efficacy, and quality, thereby fostering consumer trust. As the market for nutraceuticals expands, the demand for empty capsules is likely to increase, as they are essential for encapsulating these products. Recent data suggests that the nutraceutical market in Italy is expected to grow by approximately 5% annually, driven by favorable regulatory conditions. The empty capsule market is thus well-positioned to benefit from this supportive regulatory environment, as it aligns with the broader goals of enhancing public health and wellness.

Expansion of the Pharmaceutical Sector

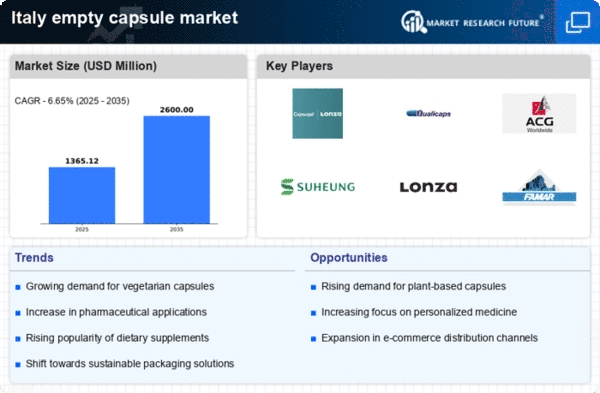

The pharmaceutical sector in Italy is undergoing significant expansion, which is positively impacting the empty capsule market. With a growing number of pharmaceutical companies investing in research and development, there is an increasing need for effective drug delivery systems. Empty capsules serve as a vital component in this context, offering advantages such as improved bioavailability and patient compliance. Recent statistics indicate that the Italian pharmaceutical market is expected to grow at a CAGR of around 4% over the next five years. This growth is likely to drive demand for empty capsules, as pharmaceutical companies seek to enhance their product offerings. The empty capsule market is thus positioned to capitalize on this trend, as it aligns with the broader objectives of the pharmaceutical sector to innovate and improve therapeutic outcomes.

Rising Popularity of Dietary Supplements

The increasing popularity of dietary supplements significantly influences the empty capsule market in Italy. As consumers seek to enhance their nutritional intake, the demand for various supplements, including vitamins, minerals, and herbal products, is on the rise. This trend is supported by a growing body of research highlighting the benefits of dietary supplementation for overall health. In 2025, the dietary supplement market in Italy is projected to reach approximately €2.5 billion, reflecting a strong consumer inclination towards preventive healthcare. The empty capsule market stands to gain from this trend, as manufacturers are likely to produce a wider variety of capsules to accommodate the diverse needs of supplement consumers. This shift towards dietary supplements is expected to create new opportunities for growth within the empty capsule market.

Technological Innovations in Capsule Manufacturing

Technological advancements in capsule manufacturing are playing a crucial role in shaping the empty capsule market in Italy. Innovations such as the development of new materials and production techniques are enhancing the efficiency and quality of capsule production. For instance, the introduction of non-gelatin capsules has opened new avenues for catering to vegetarian and vegan consumers. Furthermore, advancements in automation and quality control processes are likely to improve production scalability and reduce costs. As the empty capsule market embraces these technological innovations, it is expected to enhance product offerings and meet the evolving demands of consumers. This focus on innovation may also lead to increased competition among manufacturers, ultimately benefiting the market as a whole.