Rising Demand for Automation

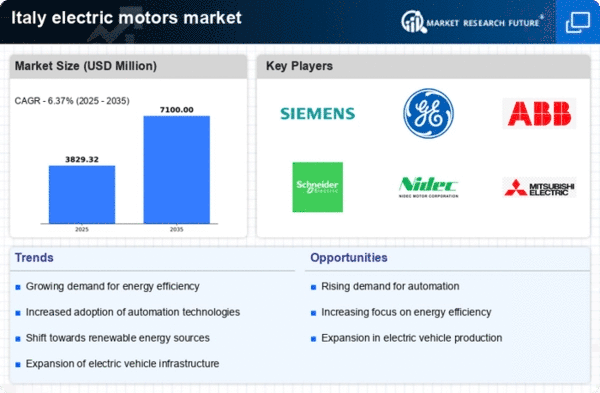

the electric motors market experiences a notable surge in demand driven by the increasing automation across various industries. Sectors such as manufacturing, automotive, and food processing are increasingly adopting automated systems to enhance productivity and efficiency. This trend is reflected in the market data, which indicates that the automation sector is projected to grow at a CAGR of approximately 7% over the next five years. As industries seek to optimize operations, the reliance on electric motors for driving automated machinery becomes paramount. Consequently, this rising demand for automation is likely to propel the electric motors market forward, as manufacturers strive to meet the evolving needs of their clients.

Growth in Renewable Energy Sector

the electric motors market is significantly influenced by the growth of the renewable energy sector. With Italy's commitment to reducing carbon emissions and increasing the share of renewables in its energy mix, there is a rising demand for electric motors in applications such as wind turbines and solar energy systems. The Italian government aims to achieve a 30% share of renewable energy by 2030, which is expected to drive investments in electric motor technologies. This shift not only supports sustainability goals but also creates opportunities for innovation within the electric motors market, as manufacturers develop more efficient and reliable solutions to meet the needs of the renewable sector.

Focus on Environmental Sustainability

the electric motors market is increasingly shaped by a focus on environmental sustainability. As businesses and consumers become more environmentally conscious, there is a growing preference for energy-efficient electric motors that reduce energy consumption and lower carbon footprints. This trend is further supported by regulatory measures aimed at promoting sustainable practices across industries. The Italian government has implemented various incentives for companies that adopt green technologies, which is likely to drive the demand for electric motors that align with these sustainability goals. Consequently, this focus on environmental sustainability is expected to play a crucial role in shaping the future landscape of the electric motors market.

Increased Investment in Infrastructure

the electric motors market is poised for growth due to increased investment in infrastructure projects. The Italian government has announced substantial funding for the modernization of transportation, energy, and industrial infrastructure. This investment is expected to create a demand for electric motors in various applications, including public transportation systems, energy-efficient buildings, and industrial machinery. Market analysts suggest that the infrastructure sector could see an investment increase of approximately €50 billion over the next five years, which will likely stimulate the electric motors market as companies seek to upgrade their systems and adopt more efficient technologies.

Technological Advancements in Motor Design

Technological advancements in motor design are reshaping the electric motors market. Innovations such as improved materials, enhanced efficiency, and advanced control systems are enabling manufacturers to produce electric motors that are lighter, more efficient, and capable of operating under diverse conditions. For instance, the introduction of permanent magnet synchronous motors (PMSMs) has gained traction due to their high efficiency and compact size. This trend is supported by market data indicating that PMSMs are expected to capture a significant share of the electric motors market, potentially reaching 25% by 2027. As these advancements continue, they are likely to drive growth and competitiveness within the electric motors market.