Enhanced Security Features

Security concerns have historically hindered the widespread adoption of cryptocurrencies. However, advancements in security features for crypto ATMs are likely to bolster consumer confidence. The integration of biometric authentication and advanced encryption methods may mitigate risks associated with fraud and theft. As the crypto atm market evolves, these enhanced security measures could attract a broader demographic, including those previously hesitant to engage with digital currencies. The potential for increased user trust may lead to a surge in transactions, further solidifying the role of crypto ATMs in the financial ecosystem of Italy.

Growing Interest from Retailers

An observable trend among retailers in Italy is the increasing willingness to accept cryptocurrencies as a form of payment. This shift is likely to drive the demand for crypto ATMs, as consumers seek convenient ways to convert their digital assets into fiat currency. The crypto atm market may see a notable uptick in installations near retail locations, facilitating seamless transactions for customers. As more businesses adopt this payment method, the synergy between retail and crypto ATMs could enhance the overall market landscape, potentially leading to a 15% increase in ATM placements in high-traffic areas.

Government Initiatives and Support

The Italian government appears to be taking steps to foster a more favorable environment for cryptocurrencies. Initiatives aimed at regulating the crypto space may provide clarity and legitimacy, encouraging both businesses and consumers to engage with digital currencies. This supportive stance could stimulate the crypto atm market, as regulatory frameworks may lead to increased installations and usage of ATMs. Furthermore, government-backed educational campaigns about cryptocurrencies could enhance public understanding, potentially resulting in a 20% growth in user engagement with crypto ATMs over the next few years.

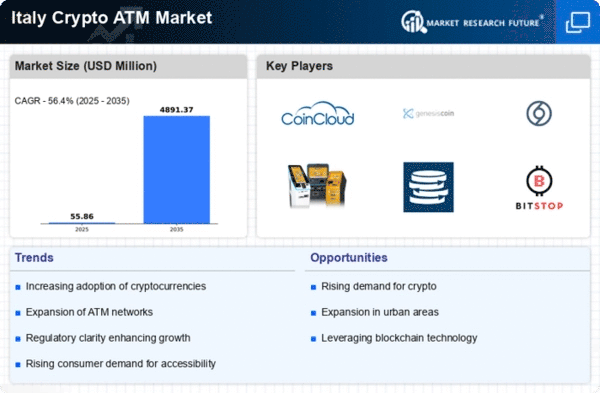

Rising Adoption of Cryptocurrencies

The increasing acceptance of cryptocurrencies among the Italian populace appears to be a primary driver for the crypto atm market. As more individuals and businesses recognize the utility of digital currencies, the demand for accessible means of acquiring them grows. Recent data indicates that approximately 10% of Italians have engaged in cryptocurrency transactions, suggesting a burgeoning interest. This trend is likely to propel the installation of crypto ATMs across urban centers, enhancing convenience for users. The crypto atm market is thus positioned to benefit from this rising adoption, as more locations become equipped with ATMs to cater to the needs of crypto enthusiasts and investors alike.

Technological Integration with Financial Services

The integration of crypto ATMs with traditional financial services is likely to be a pivotal driver for the crypto atm market. As banks and financial institutions explore partnerships with crypto ATM providers, the accessibility and functionality of these machines may improve. This collaboration could facilitate services such as instant conversions between fiat and cryptocurrencies, appealing to a broader audience. The crypto atm market may experience a transformation as these technological advancements create a more seamless user experience, potentially leading to a 30% increase in transaction volumes as consumers embrace the convenience of integrated financial solutions.