Rising Patient Awareness

There is a marked increase in patient awareness regarding biopharmaceuticals in Italy, which is influencing the market dynamics. Patients are becoming more informed about treatment options, particularly in areas such as oncology and rare diseases. This heightened awareness is leading to greater demand for innovative therapies, thereby driving growth in the biopharmaceuticals market. In 2025, it is anticipated that patient-driven initiatives will contribute to a 15% increase in the adoption of biopharmaceutical treatments. As patients advocate for access to these therapies, healthcare providers are likely to respond by expanding their offerings, further stimulating market growth.

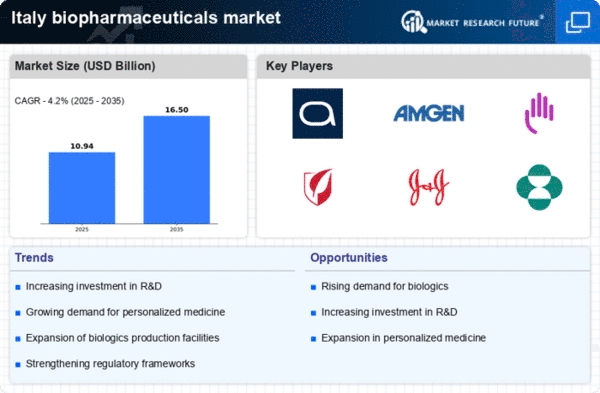

Growing Demand for Biologics

The biopharmaceuticals market in Italy is experiencing a notable surge in demand for biologics, driven by their efficacy in treating complex diseases. This trend is underscored by the increasing prevalence of chronic conditions such as cancer and autoimmune disorders, which require advanced therapeutic solutions. In 2025, the market for biologics is projected to reach approximately €10 billion, reflecting a growth rate of around 8% annually. The Italian healthcare system is adapting to this demand by integrating biologics into treatment protocols, thereby enhancing patient outcomes. This growing demand is likely to stimulate further investment in the biopharmaceuticals market, fostering innovation and development of new biologic therapies.

Advancements in Biotechnology

Technological advancements in biotechnology are significantly influencing the biopharmaceuticals market in Italy. Innovations such as CRISPR gene editing and monoclonal antibody development are paving the way for novel therapeutic approaches. These advancements not only enhance the efficacy of treatments but also reduce production costs, making therapies more accessible. In 2025, it is estimated that biotechnology-driven products will account for over 60% of the total biopharmaceuticals market revenue in Italy. This shift towards biotechnology is likely to attract investments and collaborations between research institutions and biopharmaceutical companies, further propelling the market forward.

Supportive Government Policies

The Italian government is actively promoting the biopharmaceuticals market through supportive policies and funding initiatives. Programs aimed at fostering innovation and research in biopharmaceuticals are being implemented, which include grants and tax incentives for companies engaged in R&D. In 2025, government funding for biopharmaceutical research is expected to exceed €500 million, reflecting a commitment to enhancing the country's position in the biopharmaceuticals market. These policies not only encourage domestic companies but also attract foreign investments, creating a conducive environment for growth and development in the sector.

Increasing Healthcare Expenditure

Italy's healthcare expenditure is on the rise, which is positively impacting the biopharmaceuticals market. As the government allocates more resources to healthcare, there is a corresponding increase in funding for innovative treatments and therapies. In 2025, healthcare spending is projected to reach €200 billion, with a significant portion directed towards biopharmaceuticals. This increase in expenditure is likely to enhance access to advanced therapies for patients, thereby driving demand within the biopharmaceuticals market. The growing recognition of the value of biopharmaceuticals in improving health outcomes is further fueling this trend.