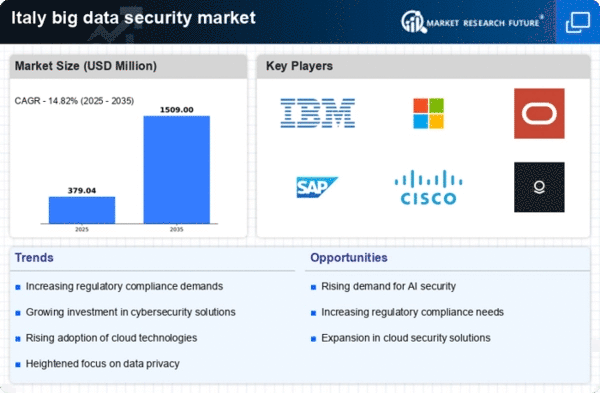

Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Italy are propelling the growth of the big data-security market. As organizations increasingly adopt cloud computing, IoT, and big data analytics, the volume of sensitive data being generated and processed has surged. This shift necessitates enhanced security measures to protect against potential breaches. In 2025, it is anticipated that the investment in digital transformation will exceed €30 billion, with a significant portion allocated to security solutions. Consequently, the big data-security market is likely to benefit from this trend, as businesses prioritize securing their digital assets amidst rapid technological advancements.

Rising Data Breaches and Cyber Threats

The increasing frequency of data breaches and cyber threats in Italy has become a critical driver for the big data-security market. Organizations are facing sophisticated attacks that compromise sensitive information, leading to financial losses and reputational damage. In 2025, it is estimated that the cost of data breaches in Italy could reach €5 billion, prompting businesses to invest heavily in security solutions. This heightened awareness of vulnerabilities is pushing companies to adopt advanced security measures, thereby expanding the big data-security market. The urgency to protect customer data and comply with regulations further fuels this trend, as organizations seek to mitigate risks associated with data handling and storage.

Growing Awareness of Cybersecurity Risks

There is a notable increase in awareness regarding cybersecurity risks among Italian businesses, which is driving the big data-security market. Companies are recognizing that the consequences of inadequate security measures can be detrimental, leading to financial losses and legal repercussions. Surveys indicate that over 70% of organizations in Italy consider cybersecurity a top priority, prompting them to allocate more resources towards security investments. This shift in mindset is likely to result in a compound annual growth rate (CAGR) of 12% for the big data-security market as firms seek to enhance their security posture and protect their data assets from evolving threats.

Emergence of Advanced Security Technologies

The emergence of advanced security technologies, such as machine learning and blockchain, is reshaping the big data-security market in Italy. These technologies offer innovative solutions to detect and respond to threats in real-time, enhancing the overall security framework of organizations. As businesses increasingly adopt these technologies, the demand for big data-security solutions is expected to rise. In 2025, the market for AI-driven security solutions alone is projected to reach €1 billion, indicating a robust growth trajectory. This trend suggests that organizations are not only investing in traditional security measures but are also exploring cutting-edge technologies to stay ahead of cyber threats.

Regulatory Compliance and Data Protection Laws

The implementation of stringent data protection laws in Italy, such as the General Data Protection Regulation (GDPR), has significantly influenced the big data-security market. Organizations are compelled to ensure compliance with these regulations to avoid hefty fines, which can reach up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory landscape drives businesses to invest in robust security frameworks and technologies that safeguard personal data. As compliance becomes a priority, the demand for big data-security solutions is expected to grow, with the market projected to expand by 15% annually as companies strive to meet legal requirements and protect consumer trust.