Emphasis on Operational Efficiency

The IT Operation Analytics Market is propelled by an increasing emphasis on operational efficiency across various sectors. Organizations are under constant pressure to reduce costs while enhancing service delivery. Analytics tools play a crucial role in identifying inefficiencies and optimizing resource allocation. Recent studies indicate that companies utilizing IT operation analytics can achieve up to a 30% reduction in operational costs. This focus on efficiency not only improves profitability but also enhances customer satisfaction, as organizations can respond more effectively to client needs. As a result, the demand for IT operation analytics solutions is expected to rise, further solidifying the market's growth trajectory.

Adoption of Automation Technologies

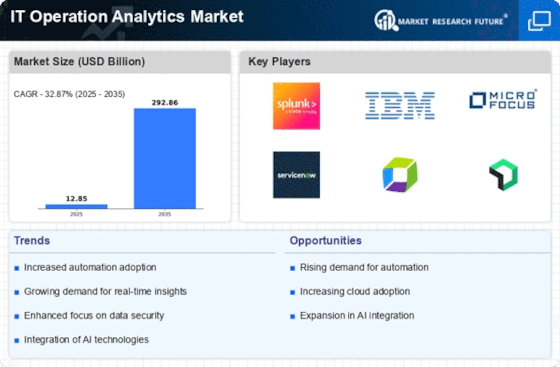

The IT Operation Analytics Market is witnessing a significant shift due to the adoption of automation technologies. Organizations are increasingly integrating automation into their IT operations to streamline processes and reduce human error. This trend is expected to drive the demand for analytics solutions that can provide insights into automated processes and their performance. By 2025, it is projected that over 70% of IT operations will incorporate some form of automation, necessitating advanced analytics to monitor and optimize these systems. Consequently, the IT Operation Analytics Market is likely to expand as businesses seek tools that can enhance their automated operations and provide actionable insights.

Increased Complexity of IT Environments

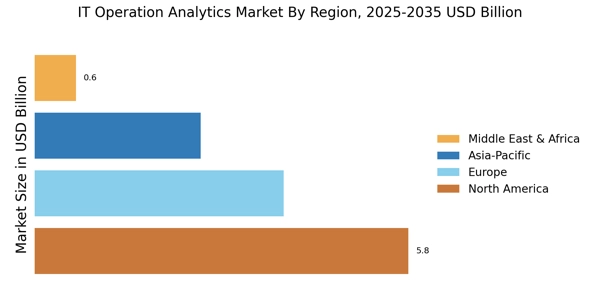

The IT Operation Analytics Market is significantly influenced by the growing complexity of IT environments. As organizations adopt multi-cloud strategies and hybrid infrastructures, the need for sophisticated analytics solutions becomes paramount. This complexity generates vast amounts of data, necessitating advanced analytics to monitor and manage IT operations effectively. It is estimated that by 2025, over 80% of enterprises will have adopted a multi-cloud strategy, further driving the demand for IT operation analytics tools. Consequently, organizations are compelled to invest in analytics solutions that can provide comprehensive visibility and actionable insights, thereby fostering growth within the IT Operation Analytics Market.

Rising Demand for Data-Driven Decision Making

The IT Operation Analytics Market is experiencing a notable surge in demand for data-driven decision making. Organizations are increasingly recognizing the value of leveraging analytics to enhance operational efficiency and drive strategic initiatives. According to recent estimates, the market for IT operation analytics is projected to reach USD 10 billion by 2026, reflecting a compound annual growth rate of approximately 15%. This growth is largely attributed to the need for real-time insights that enable businesses to respond swiftly to market changes. As companies strive to optimize their operations, the integration of advanced analytics tools becomes essential, thereby propelling the IT Operation Analytics Market forward.

Growing Importance of Compliance and Risk Management

The IT Operation Analytics Market is significantly shaped by the growing importance of compliance and risk management. As regulatory requirements become more stringent, organizations are compelled to adopt analytics solutions that can ensure compliance and mitigate risks. The market for IT operation analytics is projected to grow as companies seek to leverage data analytics to monitor compliance in real-time. It is estimated that by 2026, the compliance analytics segment will account for a substantial portion of the IT operation analytics market. This trend underscores the necessity for organizations to invest in analytics tools that not only enhance operational efficiency but also ensure adherence to regulatory standards, thereby driving growth in the IT Operation Analytics Market.