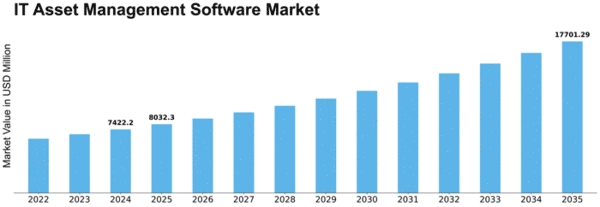

It Asset Management Software Size

IT Asset Management Software Market Growth Projections and Opportunities

IT Asset Management (ITAM) is the process of making sure that a company's assets are correctly identified, set up, taken care of, enhanced, and properly disposed of. In simple terms, it ensures that a company's important assets, both tangible and intangible, are recorded and utilized. IT assets don't last forever, so their lifespan needs to be actively managed to get the most value for the business. Every business might have its own stages for these assets, usually including planning, getting, using, maintaining, and retiring them. Applying a process across all these stages to figure out the total cost of ownership and maximize asset use is a crucial part of IT asset management.

Effective IT asset management is crucial for key ITIL processes like change, incident, and problem management. The IT team plays a vital role in empowering the entire organization to be more innovative and generate value at a faster pace. Having accurate data allows teams to respond promptly and predict the impact of changes before they happen, giving the company a competitive edge by providing widespread access to valuable insights.

To keep pace with the rapid evolution of technology, any company must strategically manage, track, and understand its IT data. However, manually keeping tabs on assets becomes increasingly challenging and time-consuming as companies deploy a greater number of them. Manual asset management systems also pose a significant risk of inconsistency due to the complex and dynamic nature of assets.

Enter IT Asset Management Software – a specialized application that oversees and monitors network IT assets. It tracks an asset throughout its life within the company. This software enables organizations to centrally manage LAN and remote work endpoints. IT Asset Management (ITAM) software empowers users to handle both hardware and software assets in their network conveniently, whether from a laptop or a mobile phone, anytime and from anywhere.

Looking at the bigger picture, the global IT Asset Management Software market is anticipated to experience a Compound Annual Growth Rate (CAGR) of 8.07% during the forecast period from 2021 to 2030. By 2030, it is projected to reach a substantial value of USD 11,878.84 million. This indicates the increasing importance and demand for IT Asset Management Software on a global scale.

Leave a Comment