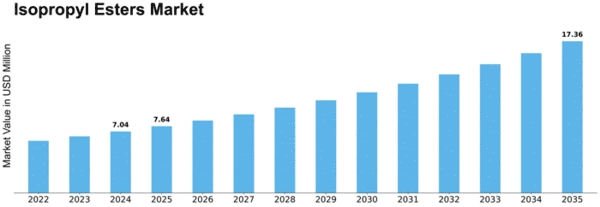

Isopropyl Esters Size

Isopropyl Esters Market Growth Projections and Opportunities

The dynamics of the Isopropyl Esters market are controlled by a variety of factors. One of them is the increasing need from sectors like personal care, pharmaceuticals and agrochemicals as a driving force. In these areas, isopropyl esters which are versatile as solvents, emollients and carriers find wide applications. Manufacturing processes in several industries rely on the performance and growth rates of these sectors that make their demand for isopropyl esters very important.

Regulatory considerations and environmental awareness play a pivotal role in the Isopropyl Esters market. Therefore, isopropyl ester used in personal care products, pharma formulations, etc., have to meet regulatory requirements that ensure product safety and environmental sustainability. To satisfy those conscious with green products producers have to follow such instructions being very important for regulations purposes. This has led to sustainable bio-based alternatives including bio-based isopropyl esters that meet present-day environmentally conscious demands.

One of the critical aspects affecting the Isopropyl Esters market is supply chain dynamics involving raw material availability as well as pricing issues. Most of these ester’s main ingredients are made out of different organic acids and iso-propanol that could be termed primary raw materials. When prices for these materials fluctuate then it increases total production costs thereby causing overall implications for this sector at large scale level. An unimaginable incidence would however undermine this stability meaning an effective, unchanging flow should be available via global supply chains.

Global trade policies plus geopolitical factors also affect the direction taken by Isopropyl Esters markets. Tariffs or trade agreements including political tensions can influence movement internationally when it comes to chemicals thus affecting demand in return too. Thus companies operating within this market must innovate or respond accordingly if they are going to successfully manage world trade intricacies.

This makes some relevance to how much share will be occupied by key players, strategic initiatives and market share in competitive dynamics of the Isopropyl Esters. In order to strengthen their position in the market, companies often place emphasis on product innovation, expanding their product portfolios as well as forming strategic partnerships. A merger or acquisition is one of the common ways used to improve market presence in order to get a lead over competitors.

Leave a Comment