Top Industry Leaders in the Isoglucose Market

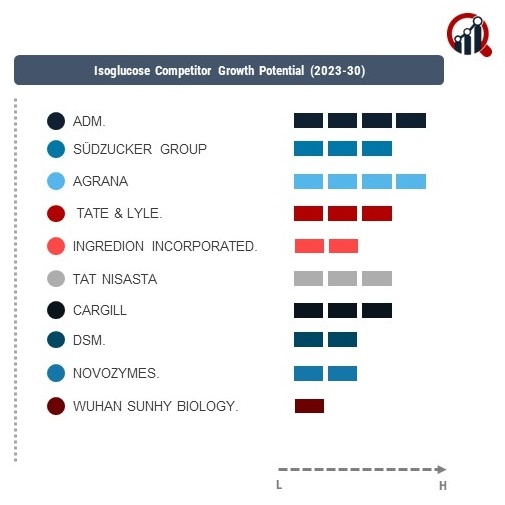

The competitive landscape of the isoglucose market is characterized by key players that contribute significantly to the production, distribution, and application of this alternative sweetener. As of 2023, major companies influencing this market include Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tereos, and Tate & Lyle PLC.

The competitive landscape of the isoglucose market is characterized by key players that contribute significantly to the production, distribution, and application of this alternative sweetener. As of 2023, major companies influencing this market include Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tereos, and Tate & Lyle PLC.

Key Players:

ADM

Sudzucker Group

Agrana

Tata & Lyle

Ingredion Incorporated

Tata Nisasta

Cargill

DSM

Novozymes

Wuhan Sunhy Biology

Strategies Adopted:

The isoglucose market revolve around product diversification, sustainable sourcing, market expansion, strategic collaborations, and customer-focused initiatives. Product diversification is crucial, with companies investing in the development of isoglucose variants tailored to specific applications and addressing consumer preferences for clean label and healthier sweetening alternatives. Sustainable sourcing initiatives involve responsible procurement of raw materials, eco-friendly production processes, and adherence to environmental and social responsibility standards. Market expansion efforts include entering new geographic regions, adapting products to regional preferences, and forming strategic alliances to address the increasing global demand for isoglucose. Strategic collaborations with food manufacturers, research institutions, and regulatory bodies facilitate the integration of isoglucose into a wide range of products and ensure compliance with industry standards. Customer-focused initiatives involve understanding consumer preferences, providing educational resources, and tailoring solutions to meet the needs of various industries.

Market Share Analysis:

the isoglucose market include product quality, pricing strategies, brand reputation, distribution networks, and regulatory compliance. Product quality, in terms of taste, stability, and purity, is essential for gaining consumer trust and meeting industry standards. Pricing strategies, whether positioned competitively or as premium products, impact market share by targeting specific consumer segments. Brand reputation plays a significant role, with well-established brands often enjoying preference in the market. Efficient distribution networks, including partnerships with food manufacturers, distributors, and retailers, contribute to market reach and accessibility. Regulatory compliance is crucial, with companies ensuring that their isoglucose products meet safety and quality standards set by regulatory authorities worldwide.

News & Emerging Companies:

The isoglucose market has witnessed the emergence of new companies and trends in response to the growing demand for alternative sweeteners. Emerging companies often focus on niche segments, such as organic or non-GMO isoglucose, to differentiate themselves in the competitive landscape. Additionally, advancements in processing technologies and sustainable production practices have gained traction among emerging players seeking to offer isoglucose with improved functionalities and reduced environmental impact.

Industry Trends:

Industry trends in the isoglucose market highlight a continued focus on sustainability, technological advancements, and market innovation. Many companies are investing in sustainable sourcing practices, energy-efficient production processes, and reducing their carbon footprint to align with the increasing consumer preference for eco-friendly products. Technological advancements involve adopting innovative processing technologies to enhance the functionality of isoglucose and cater to specific industry needs. Market innovation efforts include the development of new applications and formulations to expand the usage of isoglucose in various industries.

Competitive Scenario:

The isoglucose market remains dynamic, with established players adapting to changing consumer preferences and emerging companies contributing to innovation. Market dynamics are influenced by factors such as the demand for healthier and lower-calorie sweetening alternatives, advancements in food technology, and the regulatory landscape shaping the acceptance of isoglucose in various applications. The resilience of the market is evident in its ability to cater to diverse industries, from food and beverages to pharmaceuticals and industrial applications.

Recent Development

The isoglucose market presents a competitive landscape shaped by key players employing diverse strategies to meet the evolving demands of various industries. The emphasis on product diversification, sustainable sourcing, market expansion, strategic collaborations, and customer-focused initiatives underscores the industry's commitment to addressing changing market dynamics. As the market continues to evolve, companies that can balance innovation with sustainability and adaptability are likely to maintain a competitive edge in the dynamic landscape of the isoglucose market.

- Beta

Beta feature