Market Trends

Key Emerging Trends in the Isatoic Acid Anhydride Market

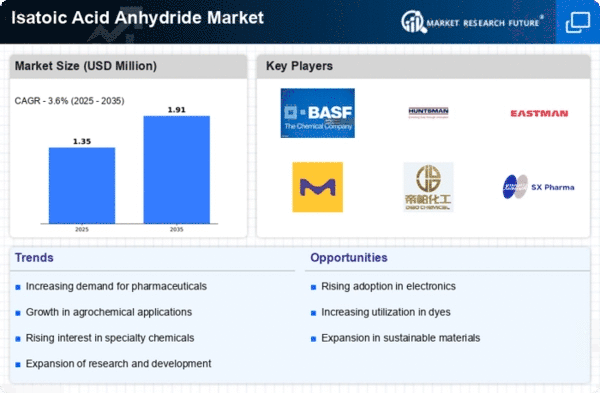

The isatoic acid anhydride market has witnessed notable trends in recent years, reflecting its diverse applications in the pharmaceutical and chemical industries. Isatoic acid anhydride, a key chemical intermediate, plays a crucial role in the synthesis of various pharmaceutical compounds and specialty chemicals. One significant trend shaping the market is the growing demand for isatoic acid anhydride in the pharmaceutical industry. As pharmaceutical research and development continue to advance, isatoic acid anhydride is increasingly used as a key building block for the synthesis of active pharmaceutical ingredients (APIs). Its versatility in facilitating complex chemical reactions makes it a valuable component in the pharmaceutical sector, contributing to the development of a wide range of medicines.

Technological advancements and innovation in isatoic acid anhydride derivatives are contributing to the market's growth. Manufacturers are investing in research and development to create novel isatoic acid anhydride-based compounds with improved properties and functionalities. These customized derivatives are designed for specific applications, offering end-users tailor-made solutions that meet their unique requirements. The versatility of isatoic acid anhydride as a chemical intermediate allows for the development of a diverse range of derivatives, expanding its application scope across various industries.

Globalization and the expansion of end-use industries in emerging economies contribute to the growth of the isatoic acid anhydride market. Rapid industrialization, increasing pharmaceutical activities, and the growth of the chemical sector in countries like China and India drive the demand for isatoic acid anhydride and its derivatives. The availability of raw materials, cost-effective manufacturing processes, and the development of a robust supply chain further support the market's expansion in these regions.

Collaborations and partnerships within the isatoic acid anhydride industry are becoming more prevalent. Companies are joining forces to enhance their research capabilities, share expertise, and develop innovative isatoic acid anhydride-based products. These collaborations aim to address industry challenges, such as cost-effective production methods, the development of new applications, and the exploration of sustainable alternatives. Strategic alliances contribute to the overall growth and competitiveness of the isatoic acid anhydride market by fostering innovation and expanding market reach.

Regulatory factors and sustainability considerations are influencing market trends in the isatoic acid anhydride industry. Stringent environmental regulations and the growing awareness of sustainable practices are prompting manufacturers to adopt greener production processes. The industry is exploring methods to minimize the environmental impact of isatoic acid anhydride production, including the development of eco-friendly synthesis routes and waste reduction initiatives. Additionally, the push towards sustainable chemistry and the use of bio-based feedstocks in isatoic acid anhydride synthesis are gaining attention as part of the industry's commitment to environmental responsibility.

Despite positive trends, challenges such as raw material availability, fluctuating prices, and the need for continuous innovation remain focal points for the isatoic acid anhydride market. The industry is focusing on securing a stable supply of raw materials, optimizing production processes, and exploring new sources of isatoic acid anhydride feedstocks to address these challenges and ensure the market's sustained growth.

Leave a Comment