Top Industry Leaders in the Isatoic Acid Anhydride Market

June 2023

A final investment decision (FID) has been made by PETRONAS Chemicals Group (PCG) to purchase the maleic anhydride (MA) plant in Gebeng, Malaysia from BASF PETRONAS Chemicals (BPC). Following the acquisition, PCG's subsidiary PETRONAS Chemicals MTBE will now oversee the operation of the MA plant, the company announced in a statement.

BPC had previously closed the MA plant following a reorganization of its product portfolio that led to the facility for butanediol (BDO) and derivatives being permanently closed. According to a statement, PCG intends to upgrade the facility so that it can produce refined MA by the second half of 2025.

With the acquisition, PCG will be able to investigate potential business opportunities in European and Middle Eastern markets and "produce MA to meet rising demand from customers in Asia-Pacific and Indian subcontinents."

The facility will make it possible to integrate MA specialty chemical derivatives in the future with both Perstorp and BRB subsidiaries to provide creative solutions and potentially work in tandem with other MA downstream manufacturers in Malaysia. MA is primarily used in the manufacture of paints, food flavoring, and unsaturated polyester resins.

June 2023

After careful consideration, Petronas Chemicals Group Bhd (PCG) has decided to fully buy the 113 kilo-tonne annual maleic anhydride (MAn) plant in Gebeng, Kuantan from BASF Petronas Chemicals Sdn Bhd (BPC).

The FID marks the beginning of the plant's project execution phase, which will modernize and revitalize the facilities in order to produce refined MAn, with a target completion date of the second half of 2025.

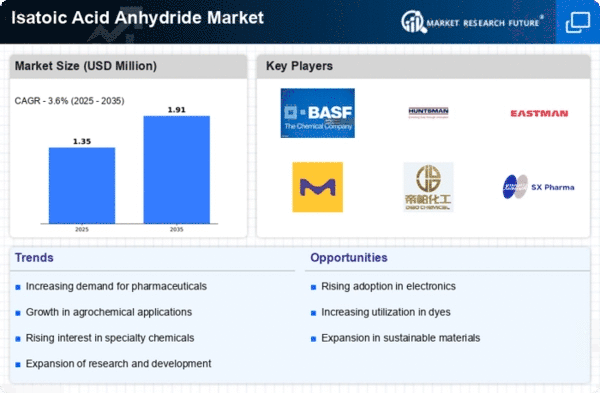

The major players in the market include BASF SE (Ludwigshafen, Germany), The Dow Chemical Company (Michigan, US), Alfa Aesar, Thermo Fisher Scientific (Massachusetts, US), Wujiang New Sunlion Chemical Co., Ltd.(Jiangsu, China), Otto Chemie Pvt. Ltd (Maharashtra, India), Muby Chemicals (Maharashtra, India), TCI (Shanghai) Development Co., Ltd.(Shanghai, China), Salvi Chemical Industries Ltd. (Maharashtra, India), Anmol Chemicals (Maharashtra, India), and Merck KGaA (Darmstadt, Germany).