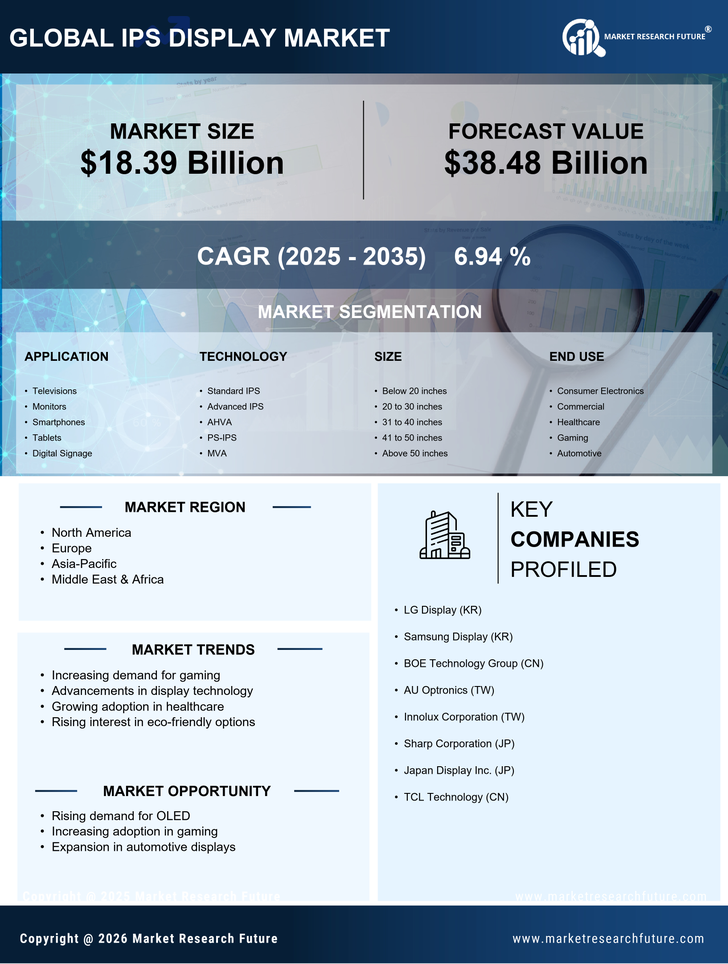

Rising Demand for Gaming Monitors with IPS Technology

The IPS Display Market is experiencing a rising demand for gaming monitors that utilize IPS technology, driven by the gaming community's desire for enhanced visual experiences. Gamers are increasingly seeking displays that offer fast response times, high refresh rates, and vibrant colors, all of which are hallmarks of IPS technology. As of October 2025, the gaming monitor segment is expected to account for approximately 30% of the overall IPS display market, with a projected market value of around 4 billion USD. This trend suggests that manufacturers may focus on developing specialized gaming monitors that leverage the advantages of IPS technology to cater to this growing audience.

Expansion of IPS Displays in Professional Applications

The IPS Display Market is witnessing an expansion in the utilization of IPS technology in professional applications, such as graphic design, video editing, and medical imaging. Professionals in these fields require displays that provide accurate color reproduction and consistent performance over time. The market for IPS displays in professional applications is projected to grow significantly, with estimates suggesting a value of 5 billion USD by 2025. This growth is indicative of the increasing recognition of IPS technology as a standard for high-performance displays, which may lead to further advancements in display technology and increased investment in research and development.

Integration of IPS Displays in Automotive Applications

The IPS Display Market is seeing a significant integration of IPS technology in automotive applications, particularly in infotainment systems and dashboard displays. As vehicles become increasingly equipped with advanced technology, the demand for high-quality displays that provide clear visibility and rich colors is on the rise. By 2025, the automotive segment of the IPS display market is anticipated to reach a valuation of approximately 3 billion USD. This growth is likely to be fueled by the automotive industry's shift towards digital interfaces, which may further enhance the appeal of IPS displays in providing an engaging user experience.

Technological Advancements in IPS Display Manufacturing

The IPS Display Market is benefiting from ongoing technological advancements in the manufacturing processes of IPS displays. Innovations such as improved panel production techniques and enhanced backlighting technologies are contributing to the reduction of production costs and the enhancement of display performance. As of October 2025, the market is projected to see a 10% decrease in manufacturing costs, which could lead to more competitive pricing for consumers. This trend may encourage wider adoption of IPS displays across various sectors, including consumer electronics and professional applications, thereby expanding the overall market.

Increasing Adoption of IPS Displays in Consumer Electronics

The IPS Display Market is experiencing a notable surge in the adoption of IPS technology within consumer electronics, particularly in smartphones, tablets, and televisions. This trend is driven by the growing consumer preference for devices that offer superior color accuracy and wider viewing angles. As of 2025, it is estimated that the market for IPS displays in consumer electronics has reached a valuation of approximately 15 billion USD, reflecting a compound annual growth rate of around 8%. This increasing demand is likely to propel manufacturers to innovate and enhance their product offerings, thereby solidifying the position of IPS displays in the competitive landscape of consumer electronics.