Ipm Pheromone Products Size

IPM Pheromone Products Market Growth Projections and Opportunities

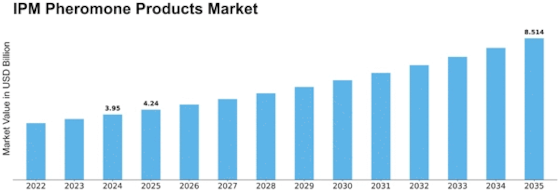

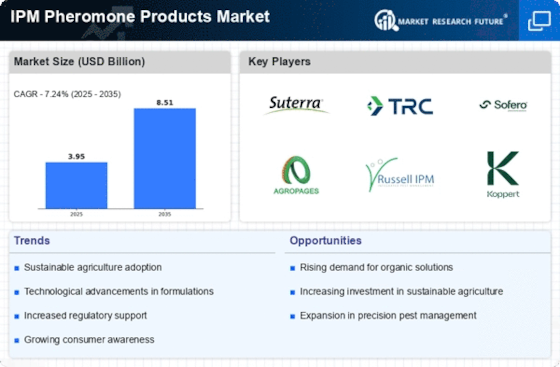

The worldwide market for IPM pheromone products has experienced substantial growth in recent years and is anticipated to achieve a valuation of USD 2.850.60 million by 2028, marking a compound annual growth rate (CAGR) of 8.54% from 2021 through 2028. This upward trajectory is attributable to various key factors driving the expansion of the global IPM pheromone products market. Among these factors, the notable drivers include significant advancements in commercial agriculture and an increasing awareness surrounding diverse IPM pheromone technologies. Additionally, the ongoing technological progressions across various forms of IPM present lucrative opportunities for stakeholders and market participants.

Despite these positive trends, certain challenges pose potential impediments to the sustained growth of the global IPM pheromone products market in the foreseeable future. One such challenge pertains to the limited awareness about these products among consumers, coupled with the prevalence of counterfeit products, particularly in emerging economies. These factors are anticipated to act as constraints, potentially impeding the market's expansion in the coming years.

The escalating growth of the global IPM pheromone products market can be primarily attributed to the rapid evolution and adoption of advanced technologies within the realm of commercial agriculture. This sector has witnessed remarkable development, embracing sophisticated IPM pheromone technologies that offer effective and environmentally friendly pest management solutions. Such advancements have garnered substantial attention and acceptance among agricultural practitioners and stakeholders, fueling the market's growth.

Moreover, the heightened consciousness regarding sustainable agricultural practices has contributed significantly to the rising demand for IPM pheromone products. These products are recognized for their role in fostering environmentally friendly pest management techniques, aligning with the global initiatives aimed at sustainable and eco-friendly agricultural practices. As a result, the market has witnessed increased traction and adoption of these products among farmers and growers worldwide.

Nevertheless, despite the optimistic growth prospects, certain challenges persist within the global IPM pheromone products market landscape. A notable concern revolves around the limited awareness and understanding of these products among end-users, especially in developing economies. This lack of awareness poses a considerable obstacle, hindering the widespread adoption and market penetration of IPM pheromone products in these regions.

Additionally, the prevalence of counterfeit or substandard products in certain emerging markets poses a significant threat to the market's growth trajectory. The availability of such products not only compromises the efficacy and quality standards but also undermines consumer confidence, impacting the overall market expansion.

In conclusion, while the global IPM pheromone products market exhibits promising growth prospects fueled by technological advancements and increased awareness, challenges related to product awareness and counterfeit products in developing regions warrant strategic interventions to ensure sustained growth and market stability in the coming years. Efforts to enhance consumer education, regulatory measures to curb counterfeit products, and continued technological innovation will be pivotal in overcoming these challenges and fostering the market's growth globally.

Leave a Comment