Rising Need for Data Analytics

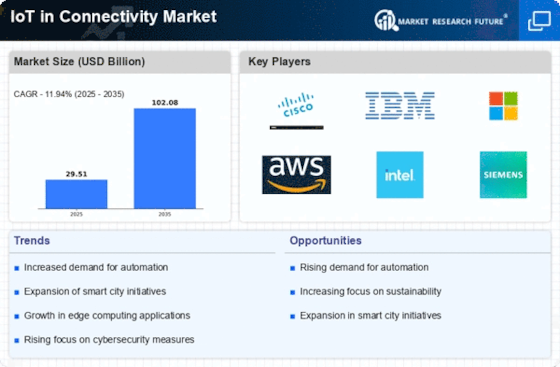

The increasing volume of data generated by IoT devices necessitates advanced data analytics capabilities, which is a crucial driver for the IoT in Connectivity Market. Organizations are recognizing the value of data-driven decision-making, leading to a surge in demand for analytics tools that can process and interpret vast datasets. As businesses seek to optimize operations and enhance customer experiences, the integration of analytics into IoT solutions becomes imperative. Market data suggests that The IoT in Connectivity is expected to reach 274 billion by 2022, indicating a strong correlation with the growth of the IoT in Connectivity Market. This trend underscores the importance of connectivity solutions that can support data transmission and processing, thereby driving innovation and investment in the sector. As a result, the need for effective data analytics is likely to shape the future landscape of the IoT in Connectivity Market.

Growing Demand for Smart Devices

The proliferation of smart devices is a primary driver in the IoT in Connectivity Market. As consumers increasingly adopt smart home technologies, wearables, and connected appliances, the demand for seamless connectivity solutions intensifies. According to recent data, the number of connected devices is projected to reach over 30 billion by 2030, indicating a robust growth trajectory. This surge necessitates advanced connectivity solutions that can support vast networks of devices, thereby propelling the IoT in Connectivity Market forward. Furthermore, the integration of artificial intelligence and machine learning into these devices enhances their functionality, creating a more interconnected ecosystem. This trend suggests that manufacturers and service providers must innovate continuously to meet the evolving needs of consumers, thereby driving competition and investment in the IoT in Connectivity Market.

Advancements in Network Technologies

The evolution of network technologies, particularly 5G, is a significant catalyst for the IoT in Connectivity Market. The deployment of 5G networks facilitates faster data transmission and lower latency, which are crucial for the effective functioning of IoT devices. With 5G expected to cover a substantial portion of the population by 2026, the implications for the IoT in Connectivity Market are profound. Enhanced connectivity capabilities enable real-time data processing and analytics, which are essential for applications in smart cities, autonomous vehicles, and industrial automation. This technological advancement not only improves user experience but also opens new avenues for innovation and service delivery. As a result, stakeholders in the IoT in Connectivity Market are likely to invest heavily in infrastructure and technology to leverage the benefits of 5G, thereby accelerating market growth.

Increased Investment in Smart Cities

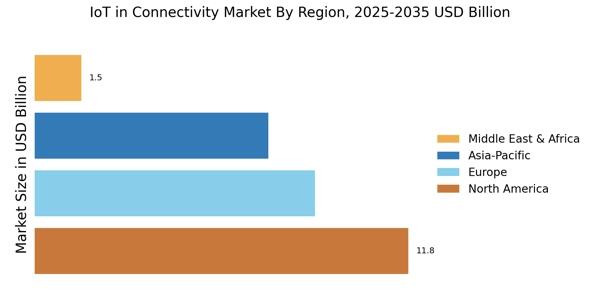

The global trend towards urbanization has led to increased investment in smart city initiatives, which serves as a significant driver for the IoT in Connectivity Market. Governments and municipalities are allocating substantial resources to develop infrastructure that integrates IoT technologies for improved efficiency and sustainability. For instance, smart traffic management systems and energy-efficient buildings rely heavily on robust connectivity solutions. Reports indicate that investments in smart city projects could exceed 2 trillion by 2025, highlighting the potential for growth in the IoT in Connectivity Market. This influx of capital not only fosters innovation but also encourages public-private partnerships, which can further enhance the development and deployment of IoT solutions. Consequently, the focus on smart cities is likely to create a favorable environment for the expansion of the IoT in Connectivity Market.

Emphasis on Sustainability and Energy Efficiency

The growing emphasis on sustainability and energy efficiency is increasingly influencing the IoT in Connectivity Market. As environmental concerns gain prominence, businesses and consumers alike are seeking solutions that minimize energy consumption and reduce carbon footprints. IoT technologies play a pivotal role in achieving these sustainability goals by enabling smarter resource management and energy monitoring. For example, smart grids and connected energy management systems can optimize energy usage, leading to significant cost savings and environmental benefits. Market trends indicate that the demand for energy-efficient solutions is expected to rise, with projections suggesting a potential market size of 1 trillion for energy management systems by 2025. This shift towards sustainability not only drives innovation within the IoT in Connectivity Market but also aligns with broader global efforts to combat climate change.