North America : Market Leader in ISP Equipment

North America is poised to maintain its leadership in the ISP Equipment MRO Services market, holding a significant market share of 8.25 in 2025. The region's growth is driven by increasing demand for high-speed internet and the expansion of 5G networks. Regulatory support for infrastructure development and investment in technology upgrades further catalyze this growth. The focus on enhancing service reliability and customer satisfaction is also a key driver in this competitive landscape.

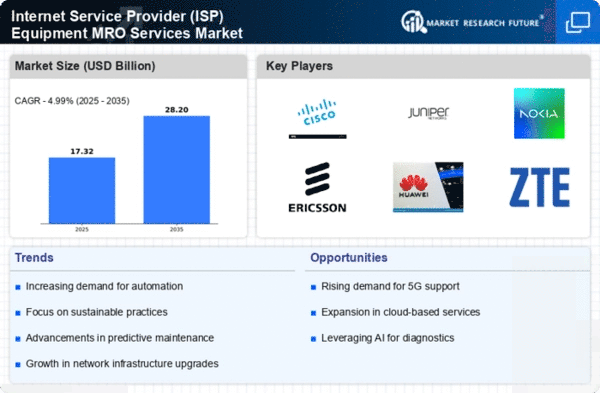

The competitive landscape in North America is characterized by the presence of major players such as Cisco Systems, Juniper Networks, and Arista Networks. These companies are investing heavily in research and development to innovate and improve their service offerings. The U.S. leads the market, followed by Canada, with a robust demand for MRO services. The region's advanced technological infrastructure and high consumer expectations create a fertile ground for growth in ISP equipment services.

Europe : Emerging Market with Growth Potential

Europe's ISP Equipment MRO Services market is on a growth trajectory, with a market size of 4.95 in 2025. The region is witnessing increased investments in digital infrastructure, driven by the European Union's commitment to enhancing connectivity and reducing the digital divide. Regulatory frameworks promoting competition and innovation are also significant growth catalysts. The demand for sustainable and efficient MRO services is rising, aligning with the EU's green initiatives.

Leading countries in this region include Germany, France, and the UK, which are home to key players like Nokia and Ericsson. The competitive landscape is evolving, with a mix of established firms and emerging startups focusing on innovative solutions. The presence of strong regulatory bodies ensures a level playing field, fostering healthy competition and driving advancements in ISP equipment services. The market is expected to grow as digital transformation accelerates across various sectors.

Asia-Pacific : Rapid Growth in Digital Services

The Asia-Pacific region is experiencing rapid growth in the ISP Equipment MRO Services market, with a market size of 2.75 in 2025. This growth is fueled by increasing internet penetration and the rising demand for digital services across countries like China, India, and Japan. Government initiatives aimed at enhancing digital infrastructure and connectivity are significant drivers. The region is also witnessing a shift towards 5G technology, which is expected to further boost MRO service requirements.

China and India are leading the charge in this market, with major players like Huawei Technologies and ZTE Corporation dominating the landscape. The competitive environment is characterized by aggressive pricing and innovation, as companies strive to capture market share. The presence of a large consumer base and increasing investments in technology make Asia-Pacific a key player in The Internet Service Provider (ISP) Equipment MRO Services, with substantial growth potential in the coming years.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is gradually emerging in the ISP Equipment MRO Services market, with a market size of 0.45 in 2025. The growth is driven by increasing internet adoption and investments in telecommunications infrastructure. However, challenges such as regulatory hurdles and varying levels of market maturity across countries can impede progress. Governments are focusing on enhancing connectivity to support economic growth, which is a positive sign for the MRO services market.

Countries like South Africa and the UAE are leading the way in this region, with key players like Ericsson and Nokia establishing a presence. The competitive landscape is still developing, with opportunities for both local and international firms. As the region continues to invest in digital transformation, the demand for ISP equipment services is expected to rise, albeit at a slower pace compared to other regions.