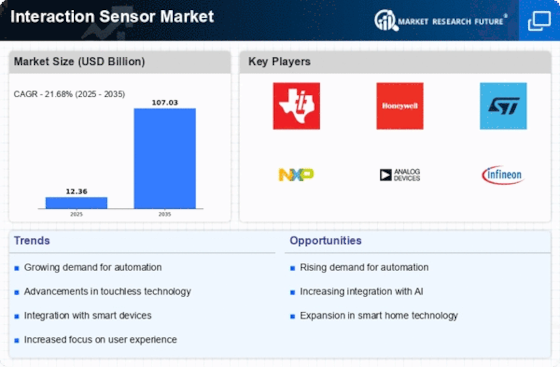

Leading market players are investing heavily in research and development to expand their product lines, which will help the interaction sensor market grow even more. Market participants are also undertaking numerous strategic activities to enhance their global footprint, with important market developments including new product launches, mergers and acquisitions, contractual agreements, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the interaction sensor industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global interaction sensor industry to benefit clients and increase the market sector. Major players in the interaction sensor market, including Google Inc. (US), Analog Devices, Inc. (US), Omron Corporation (Japan), NXP Semiconductors N.V. (Netherlands), Infineon Technologies (US), and others, are attempting to increase market demand by investing in research and development operations.Bosch Ltd, a subsidiary of Robert Bosch GmbH, manufactures auto components and home appliances. The company offers automotive products such as gasoline systems, diesel systems, chassis systems controls, electrical drives, starter motors and generators, automotive electronics, aftermarket products and steering systems. It manufactures home appliances such as tumble dryers, washer dryers, washing machines, microwaves and built-in hobs. Bosch also offers built-in ovens, fridge freezers, chimneys, food processors and kettles. Bosch also manufactures industrial equipment, consumer goods, and energy, building technological goods. The company provides testing, energy and building solution, engineering and business solutions, hardware and software and aftermarket services.

In April Bosch collaborated with AWS, a subsidiary of Amazon. With this collaboration, the firm focused on digitalizing logistics by offering an interaction platform powered by AWS. The platform facilitated logistics and transportation firms to take advantage of the possibilities of digitalization by allowing seamless interaction between data and services, thereby rendering the requirement for cost and resource-intensive IT projects redundant.Google LLC, a subsidiary of Alphabet Inc, delivers search and advertising services on the Internet. The firm's business areas include advertising, search, platforms and working systems, and enterprise and hardware products. Its portfolio of products and services includes Google Chrome, Google Play, Google Docs, Google Calendar, Google Photos, Google Meet, Google Search, Google Drive, Google Finance, Google News, Google Earth, Google Play Books, Google Ad Manager, AdMob, Google Maps, AdSense, Google Groups, Gmail, and YouTube.

In January Google received US Regulator (FCC) approval for using a motion-sensing device established on radar.The instrument, named Soli sensor, is capable of capturing motion in 3-D space by utilizing a radar beam to permit touchless control of features or functions, which helps users with speech or mobility impairments. This virtual equipment approximated human hand motion with precision. The sensor could be programmed into phones, wearables, computers, and vehicles.