-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Segment rivalry

-

Value Chain/Supply Chain of Global Integration Platform as a Service Market

-

Industry Overview of Global Integration Platform as a Service Market

-

Introduction

-

Growth Drivers

-

Impact analysis

-

Market Challenges

-

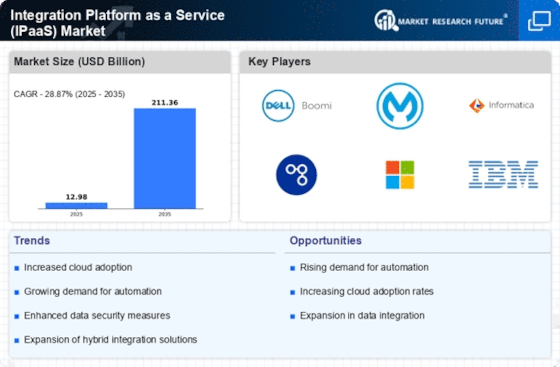

Market Trends

-

Introduction

-

Growth Trends

-

Impact analysis

-

Global Integration Platform as a Service Market by Service Type

-

Introduction

-

Cloud Service Orchestration

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Data Transformation

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

API Management

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Data Integration

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Real-Time Monitoring & Integration

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Business to Business (B2B) & Cloud Integration

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Application Integration

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Training & Consulting

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Support & Maintenance

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Integration Platform as a Service Market by Deployment

-

Introduction

-

Public Cloud

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Private Cloud

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Hybrid Cloud

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Integration Platform as a Service Market by Organization Size

-

Introduction

-

SMEs

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Large Enterprises

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Integration Platform as a Service Market by Vertical

-

Introduction

-

BFSI

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Healthcare

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Manufacturing

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Education

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Media & Entertainment

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

IT & Telecommunication

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Government

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Others

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Global Integration Platform as a Service Market by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Service Type, 2022-2030

- Market Estimates & Forecast by Deployment, 2022-2030

- Market Estimates & Forecast by Organization Size, 2022-2030

- Market Estimates & Forecast by Vertical, 2022-2030

- U.S.

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Service Type, 2022-2030

- Market Estimates & Forecast by Deployment, 2022-2030

- Market Estimates & Forecast by Organization Size, 2022-2030

- Market Estimates & Forecast by Vertical, 2022-2030

- Germany

- France

- Italy

- Spain

- U.K

-

Asia Pacific

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Service Type, 2022-2030

- Market Estimates & Forecast by Deployment, 2022-2030

- Market Estimates & Forecast by Organization Size, 2022-2030

- Market Estimates & Forecast by Vertical, 2022-2030

- China

- India

- Japan

- Rest of Asia Pacific

-

Rest of the World

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Service Type, 2022-2030

- Market Estimates & Forecast by Deployment, 2022-2030

- Market Estimates & Forecast by Organization Size, 2022-2030

- Market Estimates & Forecast by Vertical, 2022-2030

- The Middle East & Africa

- Latin America

-

Company Landscape

-

Company Profiles

-

Dell Boomi, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Informatica Corporation (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

MuleSoft, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

IBM Corporation (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Oracle Corporation (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

SAP SE (Germany)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

SnapLogic, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Celigo, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Jitterbit, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Scribe Software Corporation (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

DBSync (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Flowgear (South Africa)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

-

LIST OF TABLES

-

Global Integration Platform as a Service Market: By Region, 2022-2030

-

North America Integration Platform as a Service Market: By Country, 2022-2030

-

Europe Integration Platform as a Service Market: By Country, 2022-2030

-

Asia-Pacific Integration Platform as a Service Market: By Country, 2022-2030

-

Middle East & Africa Integration Platform as a Service Market: By Country, 2022-2030

-

Latin America Integration Platform as a Service Market: By Country, 2022-2030

-

Global Integration Platform as a Service by Service Type Market: By Regions, 2022-2030

-

North America Integration Platform as a Service by Service Type Market: By Country, 2022-2030

-

Europe Integration Platform as a Service by Service Type Market: By Country, 2022-2030

-

Table10 Asia-Pacific Integration Platform as a Service by Service Type Market: By Country, 2022-2030

-

Table11 Middle East & Africa Integration Platform as a Service by Service Type Market: By Country, 2022-2030

-

Table12 Latin America Integration Platform as a Service by Service Type Market: By Country, 2022-2030

-

Table13 Global Integration Platform as a Service by Deployment Market: By Regions, 2022-2030

-

Table14 North America Integration Platform as a Service by Deployment Market: By Country, 2022-2030

-

Table15 Europe Integration Platform as a Service by Deployment Market: By Country, 2022-2030

-

Table16 Asia-Pacific Integration Platform as a Service by Deployment Market: By Country, 2022-2030

-

Table17 Middle East & Africa Integration Platform as a Service by Deployment Market: By Country, 2022-2030

-

Table18 Latin America Integration Platform as a Service by Deployment Market: By Country, 2022-2030

-

Table19 Global Integration Platform as a Service by Organization Size Market: By Regions, 2022-2030

-

Table20 North America Integration Platform as a Service by Organization Size Market: By Country, 2022-2030

-

Table21 Europe Integration Platform as a Service by Organization Size Market: By Country, 2022-2030

-

Table22 Asia-Pacific Integration Platform as a Service by Organization Size Market: By Country, 2022-2030

-

Table23 Middle East & Africa Integration Platform as a Service by Organization Size Market: By Country, 2022-2030

-

Table24 Latin America Integration Platform as a Service by Organization Size Market: By Country, 2022-2030

-

Table25 Global Integration Platform as a Service by Vertical Market: By Regions, 2022-2030

-

Table26 North America Integration Platform as a Service by Vertical Market: By Country, 2022-2030

-

Table27 Europe Integration Platform as a Service by Vertical Market: By Country, 2022-2030

-

Table28 Asia-Pacific Integration Platform as a Service by Vertical Market: By Country, 2022-2030

-

Table29 Middle East & Africa Integration Platform as a Service by Vertical Market: By Country, 2022-2030

-

Table30 Latin America Integration Platform as a Service by Vertical Market: By Country, 2022-2030

-

Table31 Global Deployment Market: By Region, 2022-2030

-

Table32 Global Organization Size Market: By Region, 2022-2030

-

Table33 North America Integration Platform as a Service Market, By Country

-

Table34 North America Integration Platform as a Service Market, By Service Type

-

Table35 North America Integration Platform as a Service Market, By Deployment

-

Table36 North America Integration Platform as a Service Market, By Organization Size

-

Table37 North America Integration Platform as a Service Market, By Vertical

-

Table38 Europe: Integration Platform as a Service Market, By Country

-

Table39 Europe: Integration Platform as a Service Market, By Service Type

-

Table40 Europe: Integration Platform as a Service Market, By Deployment

-

Table41 Europe: Integration Platform as a Service Market, By Organization Size

-

Europe: Integration Platform as a Service Market, By Vertical

-

Table43 Asia-Pacific: Integration Platform as a Service Market, By Country

-

Table44 Asia-Pacific: Integration Platform as a Service Market, By Service Type

-

Asia-Pacific: Integration Platform as a Service Market, By Deployment

-

Asia-Pacific: Integration Platform as a Service Market, By Organization Size

-

Asia-Pacific: Integration Platform as a Service Market, By Vertical

-

Table48 Middle East & Africa: Integration Platform as a Service Market, By Country

-

Table49 Middle East & Africa Integration Platform as a Service Market, By Service Type

-

Table50 Middle East & Africa Integration Platform as a Service Market, By Deployment

-

Table51 Middle East & Africa: Integration Platform as a Service Market, By Organization Size

-

Table52 Middle East & Africa: Integration Platform as a Service Market, By Vertical

-

Table53 Latin America: Integration Platform as a Service Market, By Country

-

Table54 Latin America Integration Platform as a Service Market, By Service Type

-

Table55 Latin America Integration Platform as a Service Market, By Deployment

-

Table56 Latin America: Integration Platform as a Service Market, By Organization Size

-

Table57 Latin America: Integration Platform as a Service Market, By Vertical

-

-

LIST OF FIGURES

-

Global Integration Platform as a Service Market Segmentation

-

Forecast Methodology

-

Five Forces Analysis of Global Integration Platform as a Service Market

-

Value Chain of Global Integration Platform as a Service Market

-

Share of Global Integration Platform as a Service Market in 2020, by country (in %)

-

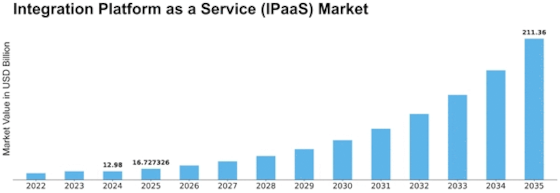

Global Integration Platform as a Service Market, 2022-2030,

-

Sub segments of Service Type

-

Global Integration Platform as a Service Market size by Service Type, 2020

-

Share of Global Integration Platform as a Service Market by Service Type, 2022-2030

-

Global Integration Platform as a Service Market size by Deployment, 2020

-

Share of Global Integration Platform as a Service Market by Deployment, 2022-2030

-

Global Integration Platform as a Service Market size by Organization Size, 2022-2030

-

Share of Global Integration Platform as a Service Market by Organization Size, 2022-2030

-

Global Integration Platform as a Service Market size by Vertical, 2022-2030

-

Share of Global Integration Platform as a Service Market by Vertical, 2022-2030

-

'

Leave a Comment