Expansion of 5G Networks

The rollout of 5G networks is significantly influencing the Integrated Telecom Infrastructure Market. With the potential to deliver data rates up to 100 times faster than 4G, 5G technology is set to revolutionize telecommunications. As of October 2025, it is estimated that over 1 billion 5G connections will be active worldwide, driving the need for robust telecom infrastructure. This expansion necessitates substantial investments in new base stations, antennas, and backhaul solutions. Telecom operators are thus focusing on enhancing their infrastructure capabilities to support the increasing number of connected devices and applications, which is likely to further stimulate growth in the Integrated Telecom Infrastructure Market.

Increased Investment in Smart Cities

The trend towards developing smart cities is a significant driver for the Integrated Telecom Infrastructure Market. Governments and municipalities are increasingly investing in advanced telecommunications infrastructure to support smart technologies, such as smart grids, intelligent transportation systems, and public safety networks. It is projected that investments in smart city initiatives will exceed 2 trillion USD by 2025. This surge in investment necessitates the deployment of integrated telecom solutions that can handle vast amounts of data and connectivity requirements. As a result, telecom companies are adapting their infrastructure to meet the demands of these smart city projects, thereby enhancing the Integrated Telecom Infrastructure Market.

Growing Need for Enhanced Data Security

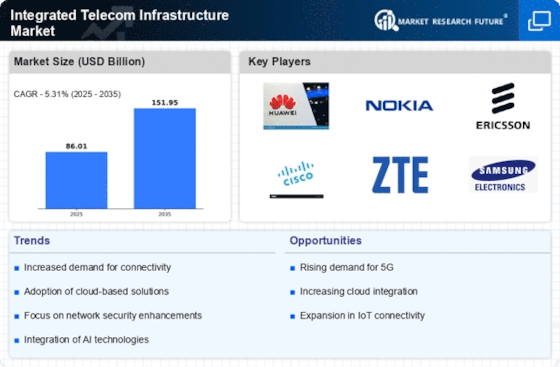

The rising concerns regarding data security and privacy are driving the Integrated Telecom Infrastructure Market. As cyber threats become more sophisticated, telecom providers are compelled to implement robust security measures within their infrastructure. The Integrated Telecom Infrastructure Market is expected to reach 300 billion USD by 2025, indicating a strong focus on securing telecom networks. This necessitates the integration of advanced security protocols and technologies into existing telecom infrastructure. Consequently, telecom companies are investing in solutions that not only enhance connectivity but also ensure the protection of sensitive data, thereby influencing the growth of the Integrated Telecom Infrastructure Market.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is a primary driver of the Integrated Telecom Infrastructure Market. As businesses and consumers alike seek faster internet speeds, telecom providers are compelled to enhance their infrastructure. This trend is evidenced by the projected growth of fiber optic networks, which are expected to reach a market value of approximately 1 trillion USD by 2025. Enhanced connectivity not only supports everyday activities but also facilitates the growth of emerging technologies such as IoT and 5G. Consequently, telecom companies are investing heavily in upgrading their infrastructure to meet these demands, thereby propelling the Integrated Telecom Infrastructure Market forward.

Shift Towards Unified Communications Solutions

The shift towards unified communications solutions is emerging as a key driver for the Integrated Telecom Infrastructure Market. Businesses are increasingly adopting integrated communication platforms that combine voice, video, and messaging services into a single solution. This trend is expected to grow, with the unified communications market projected to reach 100 billion USD by 2025. As organizations seek to improve collaboration and productivity, telecom providers are adapting their infrastructure to support these unified solutions. This adaptation involves enhancing network capabilities and ensuring seamless integration of various communication tools, which is likely to propel the growth of the Integrated Telecom Infrastructure Market.