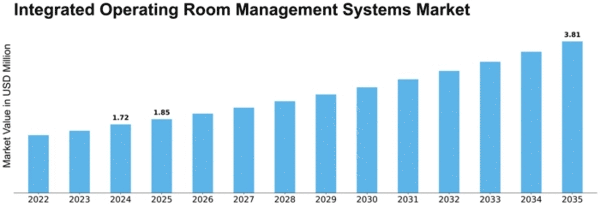

Integrated Operating Room Management Systems Size

Integrated Operating Room Management Systems Market Growth Projections and Opportunities

The Integrated Operating Room Management System (IORMS) market is influenced by several key market factors that shape its growth and development. Firstly, technological advancements play a significant role in driving the market forward. As medical technology continues to evolve, there is a growing demand for integrated solutions that streamline operating room processes, enhance efficiency, and improve patient outcomes. These technological innovations include advanced imaging systems, surgical navigation tools, and integrated communication platforms, which contribute to the overall growth of the IORMS market.

Secondly, the increasing prevalence of chronic diseases and the rising demand for minimally invasive surgeries are driving the adoption of IORMS solutions. With a growing aging population and rising healthcare expenditures, there is a greater emphasis on improving surgical outcomes while reducing hospital stays and healthcare costs. Integrated operating room management systems offer benefits such as real-time data analytics, remote monitoring capabilities, and seamless integration with electronic health records, which are essential for delivering high-quality patient care in today's healthcare landscape.

Furthermore, government initiatives and regulations aimed at enhancing patient safety and healthcare quality are also influencing the IORMS market. Regulatory bodies are increasingly focusing on standardizing operating room procedures, ensuring compliance with safety protocols, and promoting the adoption of innovative technologies to improve surgical outcomes. This regulatory environment creates opportunities for IORMS vendors to develop solutions that meet stringent quality and safety standards, thereby driving market growth.

Moreover, the growing trend towards value-based healthcare and the shift towards outpatient and ambulatory surgical settings are fueling the demand for IORMS solutions. Healthcare providers are under pressure to deliver cost-effective care while maintaining high standards of quality and safety. Integrated operating room management systems help providers achieve these goals by optimizing resource utilization, minimizing surgical errors, and enhancing patient satisfaction, thereby driving market expansion.

Additionally, the increasing healthcare expenditure and infrastructure development in emerging economies present significant growth opportunities for the IORMS market. Countries such as China, India, Brazil, and Mexico are investing heavily in healthcare infrastructure to meet the growing demand for advanced medical services. As a result, there is a rising adoption of integrated operating room management systems in these regions to improve surgical outcomes, enhance patient care, and drive operational efficiency in healthcare facilities.

On the other hand, market factors such as high initial investment costs, interoperability issues, and concerns regarding data security and privacy pose challenges to the growth of the IORMS market. Healthcare organizations often face budget constraints and technical challenges when implementing integrated operating room management systems, which can hinder market growth. Furthermore, interoperability issues between different healthcare IT systems and concerns about the security and privacy of patient data remain key barriers to adoption.

Leave a Comment