Diverse Flavor Profiles

The Instant Tea Premix Consumption Market is witnessing a notable expansion in flavor innovation, which plays a crucial role in attracting a broader consumer base. Manufacturers are increasingly introducing a variety of flavors, ranging from traditional options like masala chai to exotic blends such as hibiscus and matcha. This diversification caters to the evolving tastes of consumers, who are becoming more adventurous in their beverage choices. Market data suggests that flavored tea products have seen a rise in popularity, with a significant percentage of consumers expressing interest in trying new flavors. This trend not only enhances the appeal of instant tea premixes but also encourages repeat purchases, thereby driving growth in the Instant Tea Premix Consumption Market.

Health and Wellness Trends

The growing emphasis on health and wellness is a pivotal driver in the Instant Tea Premix Consumption Market. Consumers are increasingly seeking beverages that align with their health-conscious lifestyles, leading to a rise in demand for instant tea premixes that offer functional benefits. Many instant tea products are fortified with antioxidants, vitamins, and herbal ingredients, appealing to health-oriented consumers. Recent studies indicate that the herbal tea segment is expanding rapidly, with a significant portion of the market attributed to health-focused consumers. This trend suggests that the Instant Tea Premix Consumption Market is likely to benefit from the increasing awareness of health benefits associated with tea consumption, further propelling market growth.

E-commerce and Online Retail Growth

The rise of e-commerce and online retail platforms is transforming the Instant Tea Premix Consumption Market. With the convenience of online shopping, consumers are increasingly purchasing instant tea premixes through digital channels. This shift is supported by the growing penetration of smartphones and internet access, allowing consumers to explore a wide range of products from the comfort of their homes. Market analysis indicates that online sales of food and beverage products, including instant tea, are expected to grow significantly in the coming years. This trend not only enhances accessibility for consumers but also provides manufacturers with a broader platform to reach potential customers, thereby driving growth in the Instant Tea Premix Consumption Market.

Convenience and On-the-Go Consumption

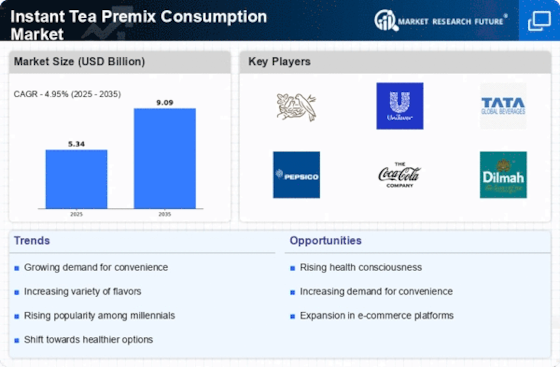

The Instant Tea Premix Consumption Market is experiencing a surge in demand due to the increasing preference for convenience among consumers. Busy lifestyles and the need for quick beverage options have led to a rise in the consumption of instant tea premixes. According to recent data, the market for ready-to-drink beverages, including instant tea, is projected to grow at a compound annual growth rate of approximately 6% over the next few years. This trend indicates that consumers are seeking products that offer ease of preparation without compromising on taste. Instant tea premixes cater to this need, providing a hassle-free solution for tea lovers who desire a quick and flavorful beverage. As a result, the convenience factor is a significant driver in the Instant Tea Premix Consumption Market.

Sustainability and Eco-Friendly Packaging

Sustainability is becoming a key consideration for consumers, influencing their purchasing decisions in the Instant Tea Premix Consumption Market. As awareness of environmental issues grows, consumers are increasingly favoring products that utilize eco-friendly packaging and sustainable sourcing practices. Many manufacturers are responding to this demand by adopting biodegradable or recyclable packaging materials for their instant tea premixes. Market Research Future indicates that a substantial percentage of consumers are willing to pay a premium for products that align with their sustainability values. This shift towards eco-conscious consumption is likely to drive growth in the Instant Tea Premix Consumption Market, as brands that prioritize sustainability may gain a competitive edge in the marketplace.