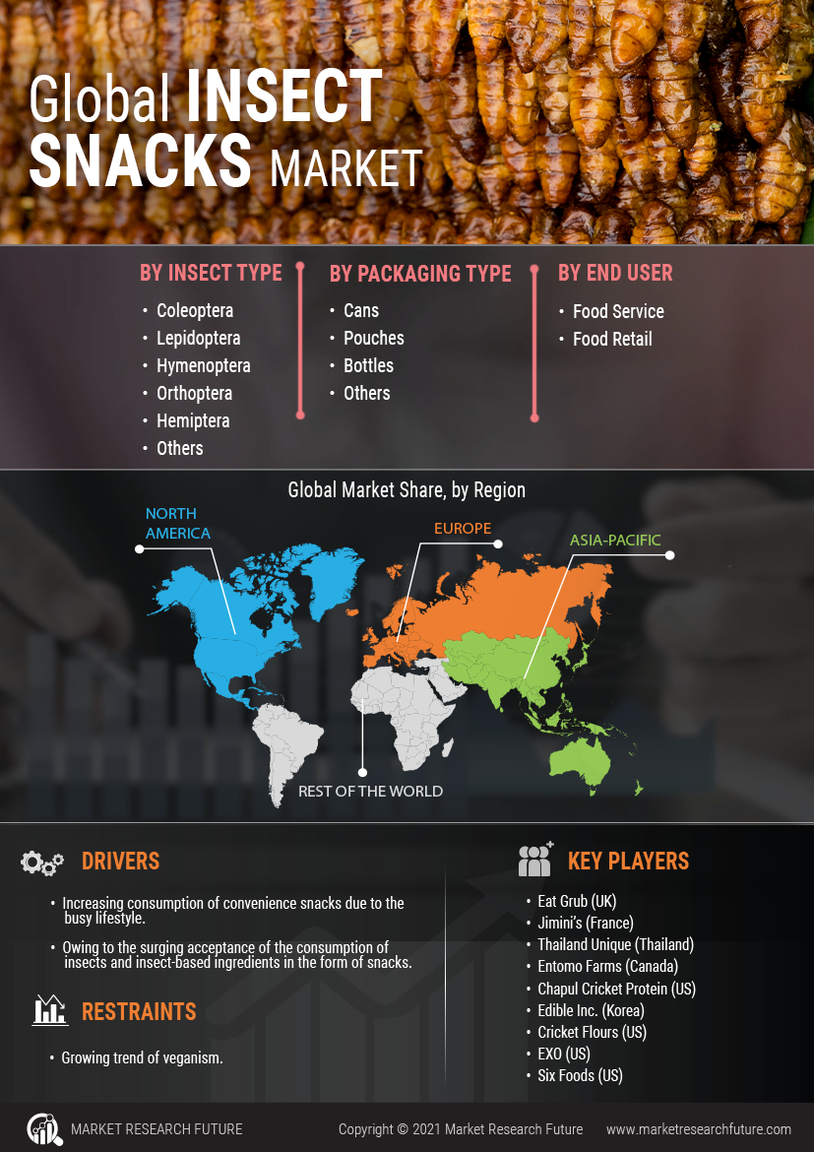

North America : Innovation and Sustainability Leader

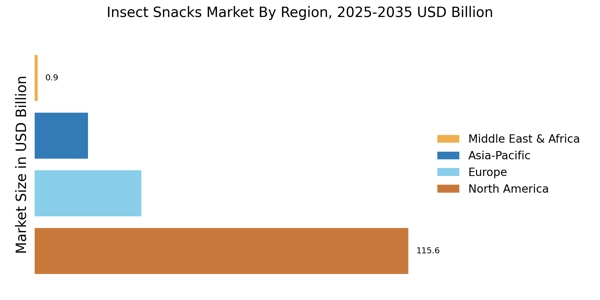

North America is witnessing a significant surge in the insect snacks market, driven by increasing consumer awareness of sustainable protein sources and health benefits. The U.S. holds the largest market share at approximately 70%, followed by Canada at 15%. Regulatory support from the FDA is fostering innovation and safety standards, encouraging new entrants and product diversification.

The competitive landscape is dominated by key players such as Exo, Chapul, and Aspire Food Group, who are pioneering various insect-based products. The U.S. market is characterized by a growing trend of incorporating insect protein into mainstream foods, with companies focusing on marketing strategies that highlight sustainability and nutritional value. This region is set to lead the global market in the coming years, with increasing investments in research and development.

Europe : Emerging Market with Regulations

Europe is rapidly emerging as a significant player in the insect snacks market, driven by a growing acceptance of entomophagy and regulatory frameworks that support innovation. The European Union has established guidelines for the use of insects in food, with countries like France and the Netherlands leading the charge. The market share in Europe is estimated at around 20%, with a strong focus on sustainability and health benefits.

Leading countries include France, Germany, and the Netherlands, where companies like Ynsect and Eat Grub are making strides in product development. The competitive landscape is characterized by a mix of startups and established food companies venturing into insect-based products. The regulatory environment is conducive to growth, with the European Food Safety Authority actively promoting the safe consumption of insects, paving the way for broader acceptance.

Asia-Pacific : Rapid Growth and Adoption

The Asia-Pacific region is experiencing rapid growth in the insect snacks market, driven by traditional consumption patterns and increasing health consciousness among consumers. Countries like Thailand and China are at the forefront, with Thailand holding a market share of approximately 10%. The region benefits from a rich history of entomophagy, which is being complemented by modern marketing strategies that promote the nutritional benefits of insect snacks.

Key players such as Bugsolutely and local startups are capitalizing on this trend, offering a variety of products that cater to both local and international markets. The competitive landscape is vibrant, with a mix of traditional practices and innovative approaches to product development. As awareness grows, the market is expected to expand significantly, supported by favorable consumer attitudes towards alternative protein sources.

Middle East and Africa : Untapped Potential in Insect Snacks Market

The Middle East and Africa region presents untapped potential for the insect snacks market, driven by increasing interest in alternative protein sources and sustainability. While the market share is currently low, estimated at around 5%, there is a growing awareness of the benefits of insect consumption. Countries like South Africa are beginning to explore regulatory frameworks to support the industry, which could catalyze growth in the coming years.

The competitive landscape is still developing, with a few local players starting to emerge. The region's diverse culinary traditions offer opportunities for innovative product development, particularly in integrating insect protein into traditional dishes. As consumer awareness increases and regulations evolve, the market is poised for gradual growth, with potential for significant expansion in the future.