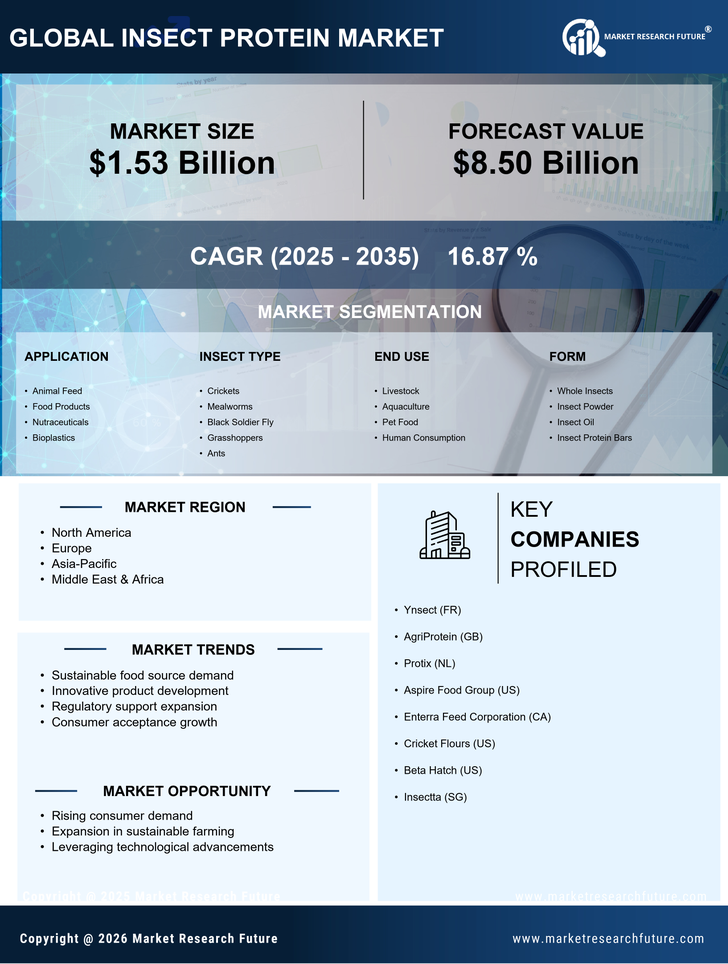

Sustainability Focus

The Insect Protein Market is experiencing a notable shift towards sustainability, driven by increasing environmental concerns. Insects require significantly less land, water, and feed compared to traditional livestock, making them a more sustainable protein source. For instance, producing one kilogram of insect protein can require up to 90% less feed than beef. This efficiency aligns with the growing demand for sustainable food sources, as consumers and businesses alike seek to reduce their carbon footprints. Furthermore, the ability of insects to convert organic waste into high-quality protein presents a compelling solution to food waste issues. As sustainability becomes a central theme in food production, the Insect Protein Market is poised for growth, appealing to environmentally conscious consumers and investors alike.

Regulatory Developments

Regulatory developments are shaping the landscape of the Insect Protein Market, as governments and organizations establish guidelines for the safe production and consumption of insect-based foods. In many regions, regulatory bodies are beginning to recognize the potential of insects as a food source, leading to the establishment of safety standards and approval processes. This regulatory support is crucial for fostering consumer confidence and encouraging investment in the industry. For example, the European Food Safety Authority has approved certain insect species for human consumption, paving the way for market expansion. As regulations evolve, the Insect Protein Market is likely to benefit from increased legitimacy and acceptance, facilitating broader market penetration.

Technological Advancements

Technological advancements are playing a crucial role in the evolution of the Insect Protein Market. Innovations in farming techniques, processing methods, and product development are enhancing the efficiency and scalability of insect protein production. For instance, automated farming systems are being developed to optimize insect rearing conditions, thereby increasing yield and reducing costs. Moreover, advancements in food technology are enabling the incorporation of insect protein into various food products, from protein bars to baked goods. This diversification not only broadens the market appeal but also helps in normalizing insect consumption among consumers. As technology continues to advance, the Insect Protein Market is expected to witness significant growth, driven by improved production capabilities and product offerings.

Health and Nutrition Awareness

The Insect Protein Market is benefiting from a rising awareness of health and nutrition among consumers. Insects are rich in essential nutrients, including protein, vitamins, and minerals, which positions them as a viable alternative to conventional protein sources. For example, crickets contain approximately 60% protein by weight and are also high in omega-3 fatty acids. This nutritional profile is increasingly appealing to health-conscious consumers, particularly in regions where protein deficiency is prevalent. Additionally, the trend towards plant-based diets has opened avenues for insect protein as a complementary source of nutrition. As more individuals seek diverse and nutrient-dense food options, the Insect Protein Market is likely to expand, catering to a demographic that values health and wellness.

Consumer Acceptance and Education

Consumer acceptance and education are pivotal drivers for the Insect Protein Market. As awareness of the benefits of insect protein grows, efforts to educate consumers about its nutritional value and sustainability are becoming increasingly important. Initiatives aimed at demystifying insect consumption, such as cooking demonstrations and tastings, are helping to shift perceptions. Surveys indicate that a significant portion of consumers is open to trying insect-based products, particularly when presented in familiar formats. This gradual acceptance is essential for the market's growth, as it encourages food manufacturers to innovate and introduce insect protein into mainstream products. As consumer education continues to evolve, the Insect Protein Market is likely to see a surge in demand, driven by a more informed and receptive public.