Inorganic Cosmetics Pigments Size

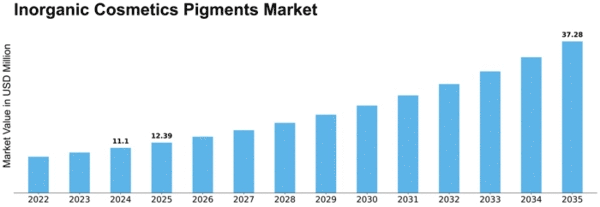

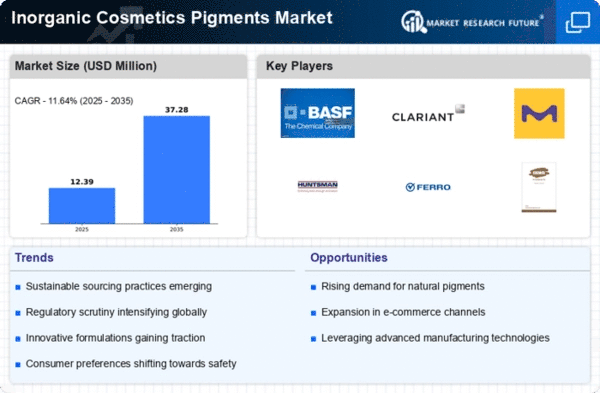

Inorganic Cosmetics Pigments Market Growth Projections and Opportunities

The Inorganic Cosmetics Pigments Market is expected to register a CAGR of 6.8% to reach around USD 7,200 million by the end of 2027.

Cosmetics Industry Demand: The primary driver of the inorganic cosmetics pigments market is the demand from the cosmetics industry, where pigments are used in various cosmetic products such as makeup, skincare, haircare, and personal care products. Inorganic pigments provide vibrant and long-lasting colors, enhancing the visual appeal and performance of cosmetic formulations. The cosmetics industry's continuous product innovation and evolving consumer trends drive market demand for a wide range of inorganic pigments used in cosmetic applications.

Color Stability and Performance: Inorganic pigments offer superior color stability, lightfastness, and chemical resistance compared to organic pigments, making them ideal for use in cosmetic formulations. Inorganic pigments provide consistent color performance and withstand exposure to light, heat, and chemicals, ensuring the durability and longevity of cosmetic products. The demand for inorganic cosmetics pigments is driven by their superior color performance and reliability in cosmetic applications.

Regulatory Compliance and Safety Standards: Regulatory compliance and safety standards governing the use of pigments in cosmetics influence market dynamics. Cosmetic manufacturers need to comply with regulatory requirements and safety standards regarding the use of inorganic pigments in cosmetic formulations to ensure product safety, consumer health, and regulatory compliance. Inorganic cosmetics pigments suppliers and manufacturers need to adhere to regulatory standards and safety regulations to meet market demand and ensure product compliance.

Technological Advancements in Pigment Production: Technological advancements in pigment production processes drive innovation in the inorganic cosmetics pigments market. Manufacturers invest in research and development to enhance pigment synthesis, purification, and dispersion techniques, improving product quality, color consistency, and performance in cosmetic formulations. Advanced pigment production technologies enable the development of a wide range of inorganic pigments with diverse colors, particle sizes, and surface treatments, catering to the evolving needs of cosmetic manufacturers and consumers.

Consumer Preferences for Natural and Mineral-Based Products: Consumer preferences for natural and mineral-based cosmetic products drive market demand for inorganic cosmetics pigments derived from mineral sources such as titanium dioxide, iron oxides, and zinc oxide. Natural and mineral-based pigments are perceived as safer alternatives to synthetic pigments and align with consumer preferences for clean, natural, and environmentally friendly cosmetic products. The demand for inorganic cosmetics pigments derived from natural and mineral sources is driven by consumer awareness of ingredient transparency, sustainability, and health-consciousness.

Market Competition and Product Differentiation: The inorganic cosmetics pigments market is characterized by intense competition among key players, driving product differentiation, innovation, and market consolidation efforts. Established pigment manufacturers leverage mergers, acquisitions, and strategic partnerships to strengthen their market presence, expand product portfolios, and enhance competitive positioning. Market players need to differentiate their products based on color range, performance characteristics, and formulation compatibility to gain a competitive edge in the inorganic cosmetics pigments market.

Global Economic Trends and Market Volatility: Global economic trends, market volatility, currency fluctuations, and geopolitical factors impact market dynamics and investment decisions in the inorganic cosmetics pigments industry. Market players need to monitor and adapt to changing economic conditions and market uncertainties to mitigate risks and capitalize on emerging opportunities.

Brand Marketing and Consumer Trends: Brand marketing strategies and consumer trends influence market demand for inorganic cosmetics pigments. Cosmetic manufacturers develop products with trendy colors, innovative formulations, and unique packaging to attract consumers and differentiate their brands in the competitive cosmetics market. The demand for inorganic cosmetics pigments is driven by consumer preferences for trendy colors, versatile formulations, and high-performance cosmetic products that meet their individual needs and lifestyle preferences.

Leave a Comment