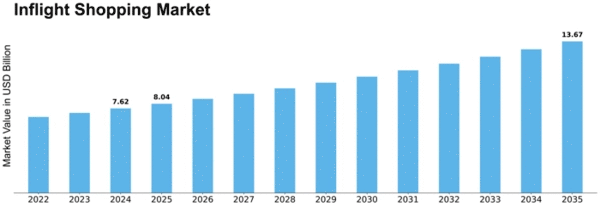

Inflight Shopping Size

Inflight Shopping Market Growth Projections and Opportunities

The inflight shopping market presents a unique intersection of retail and travel, shaped by various market factors. One significant driver is the changing consumer landscape, where passengers increasingly seek a seamless and personalized shopping experience during their flights. Airlines have recognized this trend and are leveraging inflight shopping as a revenue-generating opportunity. With the evolution of technology, airlines can offer passengers digital platforms and catalogs, allowing them to browse and purchase products during their journey, thereby enhancing the overall travel experience.

Airline partnerships and collaborations with retail brands play a pivotal role in influencing the inflight shopping market. Airlines often collaborate with well-known brands to curate an enticing selection of products for passengers. These partnerships not only contribute to the diversity of available products but also enhance the perceived value of inflight shopping. Strategic collaborations can lead to exclusive offerings, promotions, and limited-edition items, creating a sense of urgency and excitement among passengers to make purchases while onboard.

The in-flight shopping market is significantly impacted by the global tourism and travel industry. As air travel continues to grow and more people embark on international journeys, the potential customer base for inflight shopping expands. Airlines strategically position themselves to tap into this market by tailoring their inflight shopping offerings to appeal to diverse passenger demographics. Additionally, the economic prosperity of regions and countries contributes to the willingness of passengers to engage in discretionary spending, further influencing the success of inflight shopping initiatives.

The adoption of e-commerce trends is a transformative factor in the inflight shopping market. Airlines are increasingly embracing digital platforms, enabling passengers to browse, select, and purchase products through their personal devices. The convenience of mobile shopping during flights aligns with broader consumer expectations for seamless digital experiences. Airlines that invest in user-friendly, secure, and efficient inflight shopping platforms are better positioned to capture the attention of passengers and drive sales, reflecting the broader shift toward digital retail solutions.

Inflight shopping experiences are also shaped by regulatory considerations and safety protocols. Airlines must adhere to aviation regulations and safety guidelines, ensuring that the inflight shopping process does not compromise passenger safety or disrupt the normal operation of the aircraft. Striking a balance between providing a convenient shopping experience and maintaining safety standards is essential for the sustained success of inflight shopping programs.

Market competition is a driving force in the inflight shopping industry, with airlines vying to offer unique and attractive shopping experiences to passengers. The differentiation lies not only in the selection of products but also in the presentation, pricing strategies, and overall customer engagement. Airlines that understand the preferences of their target audience and tailor their inflight shopping offerings accordingly are more likely to succeed in a competitive market where passenger loyalty and satisfaction are paramount.

Economic factors, including consumer spending patterns and discretionary income, influence the success of inflight shopping initiatives. During periods of economic growth and increased consumer confidence, passengers may be more inclined to make discretionary purchases onboard. Conversely, economic downturns may impact passenger spending habits, necessitating strategic adjustments in pricing, promotions, and product offerings to maintain the appeal of inflight shopping.

Leave a Comment