Technological Integration

The integration of advanced technologies into the Inertial Systems Transportation Market is a pivotal driver. Innovations such as artificial intelligence, machine learning, and enhanced sensor technologies are transforming traditional inertial systems. These advancements enable more accurate navigation and positioning, which is crucial for various transportation modes, including aerospace and automotive sectors. The market for inertial navigation systems is projected to reach approximately 12 billion USD by 2026, reflecting a compound annual growth rate of around 7.5%. This growth is indicative of the increasing reliance on sophisticated inertial systems to enhance operational efficiency and safety in transportation.

Focus on Safety and Reliability

The emphasis on safety and reliability in transportation systems is a significant driver for the Inertial Systems Transportation Market. As transportation modes evolve, the demand for systems that ensure accurate navigation and minimize risks is increasing. Inertial systems are integral to achieving these safety standards, particularly in aviation and maritime sectors. Regulatory bodies are increasingly mandating the use of advanced inertial navigation systems to enhance operational safety. This focus on safety is expected to propel the market, as stakeholders prioritize investments in technologies that mitigate risks and enhance reliability in transportation.

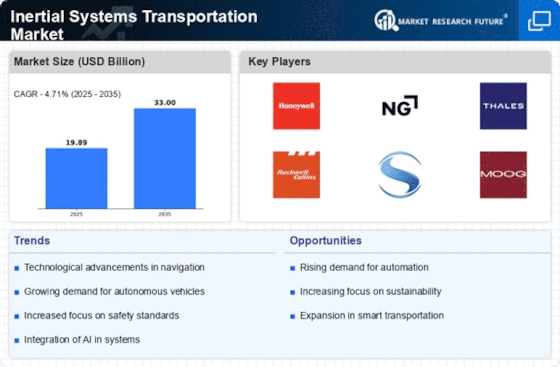

Rising Demand for Autonomous Vehicles

The burgeoning demand for autonomous vehicles significantly influences the Inertial Systems Transportation Market. As manufacturers strive to develop self-driving technologies, the need for precise inertial navigation systems becomes paramount. These systems provide critical data for vehicle positioning and movement, ensuring safety and reliability. According to recent estimates, the autonomous vehicle market is expected to surpass 60 billion USD by 2030, with inertial systems playing a crucial role in this evolution. The integration of inertial systems into autonomous vehicles not only enhances navigation accuracy but also contributes to the overall advancement of smart transportation solutions.

Emerging Applications in Defense and Aerospace

Emerging applications of inertial systems in defense and aerospace sectors are driving growth in the Inertial Systems Transportation Market. The need for precise navigation and targeting systems in military operations has led to increased demand for advanced inertial systems. Furthermore, the aerospace industry is witnessing a surge in the adoption of these systems for aircraft navigation and control. The defense sector alone is projected to invest over 20 billion USD in inertial navigation technologies by 2027. This trend underscores the critical role of inertial systems in enhancing operational capabilities and strategic advantages in defense and aerospace applications.

Increased Investment in Transportation Infrastructure

Investment in transportation infrastructure is a key driver for the Inertial Systems Transportation Market. Governments and private entities are allocating substantial resources to modernize and expand transportation networks, which necessitates the incorporation of advanced inertial systems. These systems are essential for improving the efficiency and safety of transportation operations. For instance, the U.S. Department of Transportation has earmarked billions for infrastructure projects, which include the implementation of cutting-edge navigation systems. This trend indicates a growing recognition of the importance of inertial systems in supporting robust transportation frameworks.