Growth of Renewable Energy Sources

The Industrial Semiconductors Market is significantly influenced by the growth of renewable energy sources. As the world transitions towards sustainable energy solutions, the demand for efficient power management systems is escalating. Industrial semiconductors play a crucial role in the development of inverters and converters that are essential for harnessing solar and wind energy. In 2025, the renewable energy sector is expected to account for a substantial portion of the semiconductor market, with projections indicating a growth rate of over 15% annually. This shift not only supports environmental goals but also drives innovation in semiconductor technologies, as manufacturers seek to enhance the efficiency and reliability of energy conversion systems. The increasing reliance on renewable energy sources thus emerges as a vital driver for the Industrial Semiconductors Market.

Advancements in Automotive Electronics

The Industrial Semiconductors Market is witnessing a transformative phase due to advancements in automotive electronics. The automotive sector is increasingly integrating semiconductor technologies to enhance vehicle performance, safety, and connectivity. With the rise of electric vehicles (EVs) and autonomous driving systems, the demand for high-performance industrial semiconductors is projected to grow significantly. By 2025, the automotive segment is anticipated to represent a considerable share of the semiconductor market, driven by the need for advanced driver-assistance systems (ADAS) and electric powertrains. This evolution in automotive technology necessitates the development of specialized semiconductor solutions that can withstand harsh operating conditions while delivering superior performance. Consequently, the advancements in automotive electronics serve as a key driver for the Industrial Semiconductors Market.

Increasing Demand for Smart Manufacturing

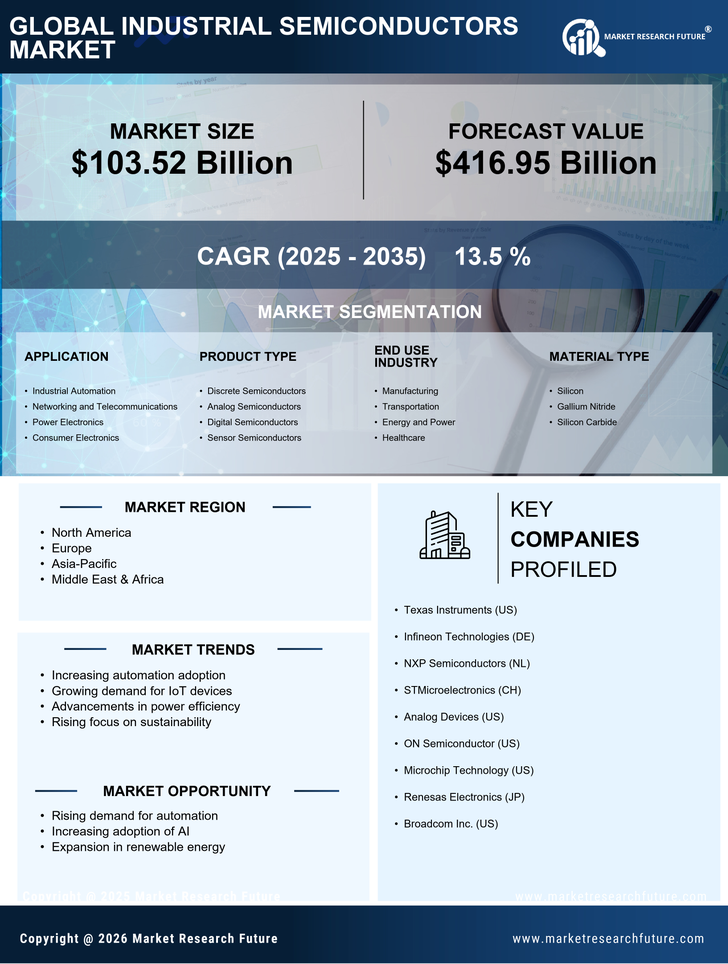

The Industrial Semiconductors Market is experiencing a notable surge in demand due to the increasing adoption of smart manufacturing practices. As industries strive for enhanced efficiency and productivity, the integration of advanced semiconductor technologies becomes essential. In 2025, the market for industrial semiconductors is projected to reach approximately 50 billion USD, driven by the need for automation and real-time data processing. This shift towards smart factories necessitates the deployment of sophisticated sensors and control systems, which rely heavily on industrial semiconductors. Consequently, manufacturers are investing in semiconductor solutions that facilitate seamless communication and data exchange, thereby optimizing operational workflows. The trend towards smart manufacturing not only enhances productivity but also contributes to reduced operational costs, making it a pivotal driver in the Industrial Semiconductors Market.

Regulatory Push for Enhanced Safety Standards

The Industrial Semiconductors Market is increasingly shaped by regulatory pushes for enhanced safety standards across various sectors. Governments and regulatory bodies are implementing stringent safety regulations that necessitate the incorporation of advanced semiconductor technologies in industrial applications. This trend is particularly evident in sectors such as manufacturing, energy, and transportation, where compliance with safety standards is paramount. By 2025, the demand for semiconductors that meet these regulatory requirements is expected to rise, as industries seek to mitigate risks and enhance operational safety. The integration of safety features in semiconductor designs not only ensures compliance but also fosters innovation in product development. Consequently, the regulatory push for enhanced safety standards serves as a crucial driver for the Industrial Semiconductors Market.

Expansion of Industrial Internet of Things (IIoT)

The Industrial Semiconductors Market is being propelled by the expansion of the Industrial Internet of Things (IIoT). As industries increasingly adopt IIoT solutions, the demand for semiconductors that enable connectivity and data processing is on the rise. In 2025, the IIoT market is projected to reach approximately 100 billion USD, with industrial semiconductors playing a pivotal role in facilitating communication between devices and systems. This integration allows for real-time monitoring and predictive maintenance, which enhances operational efficiency and reduces downtime. The proliferation of smart sensors and edge computing devices further underscores the importance of industrial semiconductors in the IIoT ecosystem. Thus, the expansion of IIoT emerges as a significant driver for the Industrial Semiconductors Market.