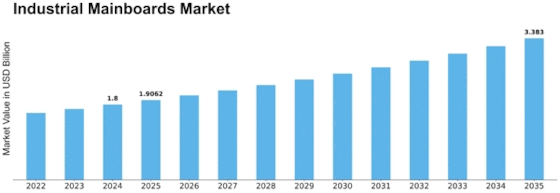

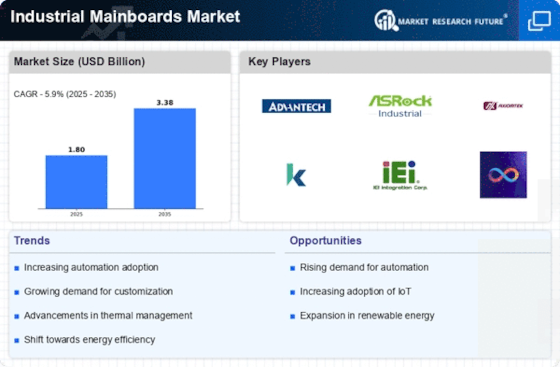

Industrial Mainboards Size

Industrial Mainboards Market Growth Projections and Opportunities

The Industrial Mainboards Market is a dynamic sector influenced by various market factors that shape its growth and trajectory. These factors play a crucial role in determining the demand, supply, and overall performance of industrial mainboards within the market. One of the primary market factors is technological advancements. As industries evolve, the demand for more advanced and efficient industrial mainboards increases. Manufacturers strive to integrate the latest technologies, such as faster processors, enhanced connectivity options, and improved durability, to meet the evolving needs of industrial applications.

Another significant market factor is the overall economic climate. The health of the economy, both globally and regionally, directly impacts the industrial mainboards market. During periods of economic growth, industries tend to invest more in upgrading their infrastructure, leading to an increased demand for industrial mainboards. Conversely, economic downturns can result in reduced capital expenditure and a slowdown in the market. Understanding and adapting to these economic fluctuations are essential for businesses operating in the industrial mainboards sector.

Regulatory factors also play a pivotal role in shaping the industrial mainboards market. Governments around the world establish regulations and standards to ensure the safety, compatibility, and sustainability of industrial equipment. Compliance with these regulations becomes a critical consideration for manufacturers, influencing product design and development. Adhering to industry standards not only ensures market acceptance but also fosters trust among consumers and stakeholders.

Market competition is another driving force in the industrial mainboards sector. As more companies enter the market, competition intensifies, leading to innovation and cost competitiveness. Manufacturers strive to differentiate their products by offering unique features, better performance, and competitive pricing. This competition not only benefits consumers by providing a variety of options but also pushes manufacturers to continually improve their products to stay ahead in the market.

Globalization is a market factor that cannot be ignored in the industrial mainboards sector. The interconnected nature of the global economy means that events in one part of the world can have ripple effects on the entire market. Supply chain disruptions, geopolitical tensions, and trade policies can impact the availability and pricing of industrial mainboards. Manufacturers must navigate these global dynamics to ensure a resilient and adaptable business model.

The rise of Industry 4.0 and the Internet of Things (IoT) has significantly influenced the industrial mainboards market. As industries embrace smart technologies and connectivity, the demand for industrial mainboards capable of supporting these advanced applications increases. The ability to integrate with IoT devices, facilitate data exchange, and support real-time processing becomes a critical factor for manufacturers in this evolving landscape.

Lastly, environmental sustainability is emerging as a crucial market factor. With increasing awareness of environmental issues, industries are seeking eco-friendly solutions, including industrial mainboards with lower energy consumption and reduced environmental impact. Manufacturers that prioritize sustainability in their product development and production processes are likely to gain a competitive edge in the market.

Leave a Comment