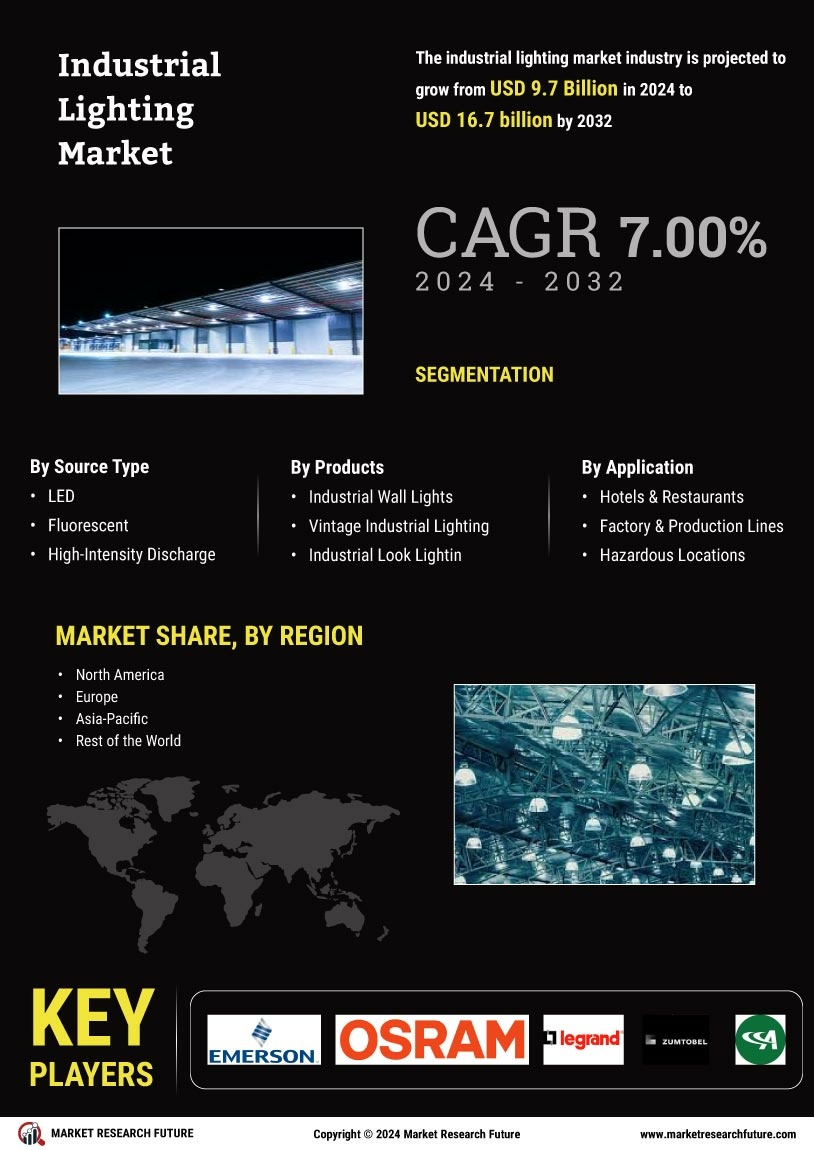

The Industrial Lighting Market is currently experiencing a transformative phase, driven by advancements in technology and a growing emphasis on energy efficiency across the broader lighting industry news, lighting news, and led lighting news ecosystem. As industries increasingly prioritize sustainability, the demand for innovative lighting solutions and new lighting technologies that reduce energy consumption while enhancing productivity is on the rise. This shift is evident in the adoption of LED technology, including developments seen within cree industrial lighting, cooperlighting, cooper lighting llc, and advanced us architectural lighting systems.

Furthermore, the integration of smart lighting systems is becoming more prevalent, allowing for greater control and customization in various industrial settings. Companies are exploring solutions aligned with inside lighting, inside led, led inside, and advanced inside lighting fixtures, while solutions from brands such as waclighting, wac lighting led, visa lighting, barron lighting, asi lighting, anp lighting, hylite lighting, vode lighting, bold lighting, and wage lighting & design demonstrate innovation across the sector.

In addition to technological advancements, regulatory frameworks are evolving to support greener practices within the Industrial Lighting Market and broader lighting business environment. Governments worldwide are implementing stricter energy efficiency standards, compelling manufacturers to innovate and comply with these regulations. Overall, the Industrial Lighting Market appears poised for substantial growth, supported by trends in led lighting trends, lighting industry, and developments reported across lighting people communities and lighting industry news platforms.

Rise of Smart Lighting Solutions

The Industrial Lighting Market is witnessing a notable shift towards smart lighting technologies, contributing to growth in the smart lighting market and expansion of in lighting automation systems. These systems utilize sensors and automation to optimize energy usage, enhance safety, and improve operational efficiency, reflecting innovations across core lighting, insight lighting, and modern industries lighting environments.

Focus on Energy Efficiency

A growing emphasis on energy efficiency is reshaping the Industrial Lighting Market. Companies are increasingly adopting lighting solutions that minimize energy consumption while maximizing output. This trend is supported by advancements in usled lighting, enhanced usa illumination, and increased awareness within the lighting business landscape.

Integration of Sustainable Practices

Sustainability is becoming a core principle within the Industrial Lighting Market and wider industry lighting evolution. Manufacturers are exploring eco-friendly materials and production methods while aligning with global lighting and lighting. Innovation initiatives and expanding interior lighting services and inside light applications.