Top Industry Leaders in the Industrial Gases Market

*Disclaimer: List of key companies in no particular order

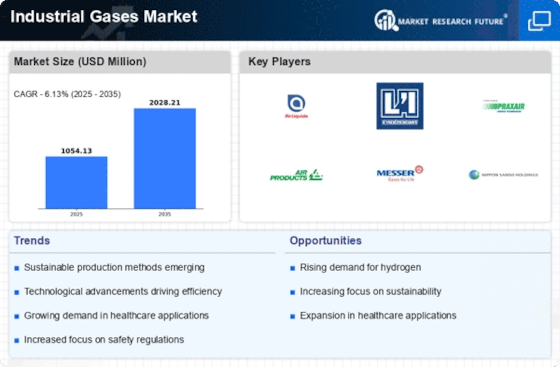

The Global Industrial Gases Market is characterized by fierce competition, with a select group of major players dominating the landscape. Linde PLC (Ireland), Air Liquide (France), BASF SE (Germany), Air Products and Chemicals Inc. (US), Messer Group GmbH (Germany), Iwatani Corporation (Japan), SOL Group (Italy), Matheson Tri-gas Inc. (US), Taiyo Nippon Sanso Corporation (Japan), Elliniki Gases S.A. (Greece), and others shape the industry's competitive dynamics. These industry giants have forged formidable global networks, diverse product portfolios, and substantial investments in research and development (R&D).

Key Player Strategies:

Mergers and Acquisitions: Major players actively engage in mergers and acquisitions to consolidate market share, expand geographical presence, and acquire cutting-edge technologies. For instance, Linde's acquisition of Praxair in 2018 bolstered its position as the global leader.

Innovation and R&D: Leaders continuously invest in R&D to pioneer new technologies and applications. Advancements in gas separation, cryogenic equipment, and gas delivery systems exemplify their commitment to innovation.

Expansion into Emerging Markets: Recognizing growth opportunities in developing economies, major players extend operations into Asia Pacific, Latin America, and Africa. This involves establishing production facilities, building distribution networks, and forming partnerships with local entities.

Vertical Integration: Some companies adopt vertical integration, delving into raw material and equipment production for the industrial gas manufacturing process. This strategy aims to secure a stable supply chain and gain control over pricing and production costs.

Strategic Partnerships: To access new markets and technologies, major players form strategic partnerships with universities, research institutions, and technology startups.

Factors for Market Share Analysis:

-

Market Share: Determined by revenue and volume of industrial gas sales.

-

Geographical Reach: Assessing a player's global presence and its ability to cater to diverse regional markets.

-

Product Portfolio: Evaluating the diversity of industrial gas products, including bulk gases, specialty gases, and on-site gas generation plants.

-

Technology and Innovation: Considering investment in R&D and the development of new gas production and delivery technologies.

-

Distribution Network: Examining the efficiency and reach of a player's distribution network, encompassing pipeline networks, bulk storage facilities, and cylinder filling stations.

-

Customer Service: Assessing the quality of customer service and technical support provided by a player.

New and Emerging Trends:

Digitalization: Companies increasingly adopt digital technologies like automation, AI, and IoT to optimize operations and enhance customer service.

Sustainability: Environmental sustainability becomes a focal point, encompassing efforts to reduce greenhouse gas emissions, develop renewable energy sources, and offer carbon capture and storage solutions.

Circular Economy: Exploring ways to implement circular economy principles, minimizing waste, recycling materials, and extending equipment lifespan.

On-site Gas Generation: Growing popularity due to cost, efficiency, and reliability advantages, prompting companies to invest in developing more efficient on-site gas generation technologies.

Overall Competitive Scenario:

The industrial gases market is poised to remain intensely competitive, with major players vying for supremacy based on price, product quality, service, and technological innovation. Collaborations, especially in R&D and joint ventures, are on the rise, while new entrants, particularly in developing economies, are expected to further intensify competition.

Despite the cutthroat competition, the industrial gases market's outlook is optimistic, driven by increasing demand across various industries and ongoing technological advancements. Major players, with their global presence, diverse product portfolios, and commitment to innovation, are well-positioned to capitalize on this growth. However, adapting strategies to address evolving market challenges, such as sustainability concerns and the emergence of new technologies, remains imperative.

Company-Specific Updates:

Linde PLC (Ireland):

- October 26, 2023: Announced a partnership with Plug Power to develop and manufacture hydrogen refueling stations in North America. (Source: Linde press release)

Air Liquide (France):

- November 16, 2023: Signed an agreement with ArcelorMittal to supply hydrogen for its steel plant in France. (Source: Air Liquide press release)

BASF SE (Germany):

- October 25, 2023: Partnered with thyssenkrupp to develop and produce green hydrogen for steel production. (Source: BASF press release)

Air Products and Chemicals Inc. (US):

- November 8, 2023: Signed a contract to supply hydrogen to a new biofuel plant in California. (Source: Air Products press release)

Messer Group GmbH (Germany):

- October 18, 2023: Acquired Air Products' industrial gases business in Poland and the Czech Republic. (Source: Messer press release)