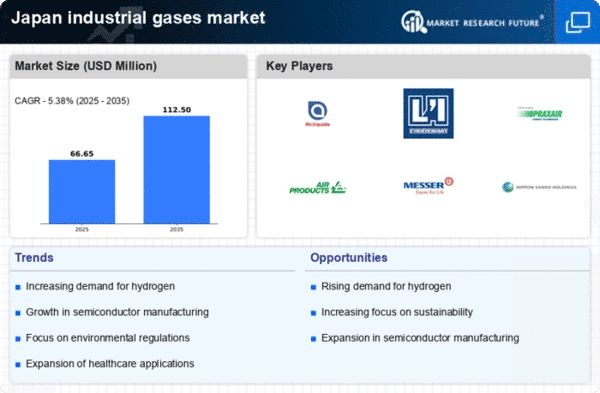

The industrial gases market in Japan is characterized by a competitive landscape. This landscape is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Air Liquide (FR), Linde (DE), and Taiyo Nippon Sanso Corporation (JP) are actively pursuing strategies that emphasize technological advancements and regional expansion. Air Liquide (FR) focuses on enhancing its product offerings through digital transformation, while Linde (DE) is known for its commitment to sustainability initiatives, which are becoming critical in the current market environment. Taiyo Nippon Sanso Corporation (JP) is leveraging its strong local presence to optimize supply chains and improve operational efficiencies, thereby influencing the competitive dynamics significantly. The market structure appears moderately fragmented, with several players vying for market share. Key tactics employed by these companies include localizing manufacturing processes and optimizing supply chains to enhance responsiveness to customer needs. This collective approach not only strengthens their market positions but also fosters a competitive environment where innovation and efficiency are paramount. In September 2025, Air Products and Chemicals (US) announced a strategic partnership with a leading Japanese technology firm to develop advanced hydrogen production technologies. This collaboration is expected to enhance Air Products' capabilities in the hydrogen sector, aligning with global trends towards cleaner energy solutions. The strategic importance of this partnership lies in its potential to position Air Products as a leader in the rapidly evolving hydrogen market, which is critical for achieving sustainability goals. In October 2025, Linde (DE) unveiled a new facility in Japan dedicated to the production of specialty gases for the semiconductor industry. This investment underscores Linde's commitment to supporting high-tech industries in Japan, which are vital for the country's economic growth. The establishment of this facility not only enhances Linde's operational footprint but also reflects its strategy to cater to the increasing demand for high-purity gases in advanced manufacturing processes. In August 2025, Messer Group (DE) expanded its operations in Japan by acquiring a local gas supplier, thereby strengthening its market presence. This acquisition is indicative of Messer's strategy to enhance its distribution network and improve service delivery to customers. The move is likely to bolster Messer's competitive position by allowing it to offer a more comprehensive range of products and services tailored to local market needs. As of November 2025, the competitive trends in the industrial gases market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to drive innovation and meet evolving customer demands. The shift from price-based competition to a focus on technological advancements and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market conditions.