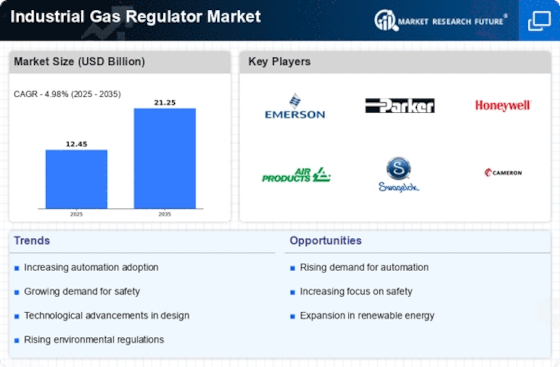

North America : Market Leader in Innovation

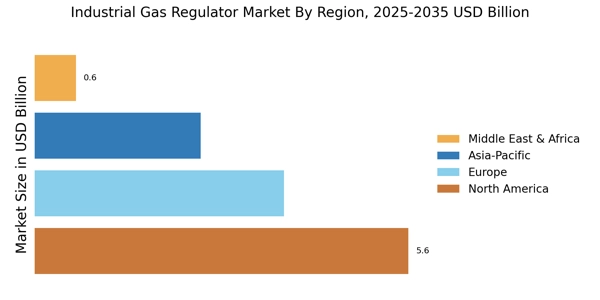

North America is the largest region for Industrial Gas Regulators Market, holding approximately 45% of the global market share. The region's growth is driven by increasing demand from the manufacturing and healthcare sectors, alongside stringent safety regulations that necessitate high-quality gas regulation systems. The presence of major players like Emerson Electric and Honeywell further fuels market expansion, supported by technological advancements and innovation in gas regulation solutions.

The United States is the leading country in this region, accounting for the majority of market share. Canada follows as the second-largest market, benefiting from its robust industrial base and energy sector. The competitive landscape is characterized by key players such as Parker Hannifin and Air Products, which are continuously innovating to meet the evolving needs of various industries. The focus on safety and efficiency in gas management is driving investments and partnerships among these companies.

Europe : Regulatory Framework Driving Growth

Europe is witnessing significant growth in the Industrial Gas Regulator Market, driven by stringent environmental regulations and a shift towards sustainable energy solutions. The region holds approximately 30% of the global market share, with Germany and the UK being the largest contributors. Regulatory frameworks, such as the EU's Green Deal, are catalyzing investments in cleaner technologies, thereby increasing the demand for advanced gas regulation systems that comply with new standards.

Germany leads the Industrial Gas Regulator Market in the European region, supported by its strong industrial base and focus on innovation. The UK follows closely, with a growing emphasis on safety and efficiency in gas management. Key players like KROHNE Group and GCE Group are actively participating in this competitive landscape, focusing on developing cutting-edge technologies to meet regulatory requirements. The presence of these companies enhances the region's capability to adapt to changing market dynamics and consumer needs.

Asia-Pacific : Rapid Growth and Expansion

Asia-Pacific is emerging as a significant player in the Industrial Gas Regulator Market, holding approximately 20% of the global market share. The region's growth is fueled by rapid industrialization, urbanization, and increasing investments in infrastructure. Countries like China and India are leading this growth, driven by their expanding manufacturing sectors and rising energy demands, which necessitate efficient gas regulation systems to ensure safety and compliance with local regulations.

China is the largest market in this region, with India following as a close second. The competitive landscape is marked by the presence of both local and international players, including Swagelok and Aalborg Instruments. These companies are focusing on innovation and cost-effective solutions to cater to the diverse needs of various industries. The increasing focus on safety standards and environmental regulations is further propelling the demand for advanced gas regulators in this rapidly evolving market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa regions are gradually emerging in the Industrial Gas Regulator Market, holding approximately 5% of the global market share. The growth is primarily driven by increasing industrial activities, particularly in oil and gas, and a rising focus on safety and efficiency in gas management. Countries like Saudi Arabia and South Africa are leading this growth, supported by government initiatives aimed at enhancing industrial capabilities and infrastructure development.

Saudi Arabia is the largest Industrial Gas Regulator Market in this region, benefiting from its vast oil reserves and ongoing investments in petrochemical industries. South Africa follows as a significant player, with a growing emphasis on safety regulations in various sectors. The competitive landscape includes both local and international companies, with key players like Air Products and Cameron International Corporation actively participating in the market. The focus on innovation and compliance with safety standards is driving the demand for advanced gas regulation solutions in this region.