Shift Towards Decarbonization

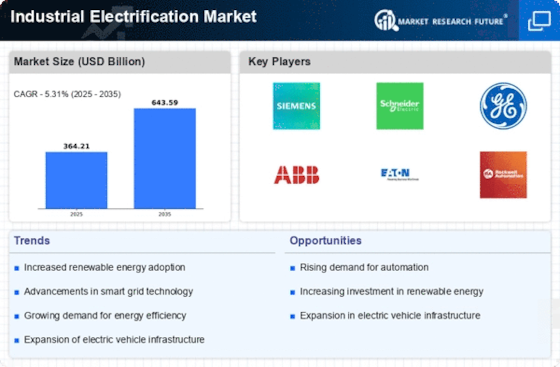

The Industrial Electrification Market is significantly influenced by the global shift towards decarbonization. Governments and organizations are increasingly committing to reducing greenhouse gas emissions, which necessitates a transition from fossil fuels to electrified processes. This transition is particularly evident in sectors such as manufacturing and transportation, where electrification can substantially lower carbon footprints. Recent studies indicate that electrification could reduce emissions by up to 70% in certain industrial applications. As a result, industries are investing in electrification technologies to comply with regulatory frameworks and meet sustainability targets. This decarbonization drive not only enhances corporate responsibility but also opens new avenues for innovation and investment in electrification solutions, thereby propelling market growth.

Rising Demand for Energy Efficiency

The Industrial Electrification Market is experiencing a notable surge in demand for energy efficiency solutions. Industries are increasingly recognizing the need to optimize energy consumption to reduce operational costs and enhance sustainability. According to recent data, energy-efficient technologies can lead to a reduction in energy use by up to 30% in industrial applications. This trend is driven by both economic incentives and environmental regulations, prompting companies to invest in electrification solutions that minimize waste and improve overall efficiency. As industries strive to meet stringent energy performance standards, the electrification of processes and equipment becomes a pivotal strategy. This shift not only aligns with corporate sustainability goals but also positions companies favorably in a competitive market, where energy efficiency is becoming a key differentiator.

Increased Investment in Infrastructure

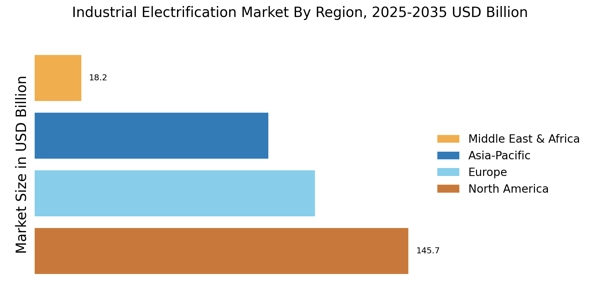

Investment in infrastructure is a critical driver for the Industrial Electrification Market. As industries transition to electrified processes, there is a growing need for robust electrical infrastructure to support this shift. This includes the development of charging stations, grid enhancements, and energy management systems. Recent reports suggest that investments in electrification infrastructure could reach billions of dollars over the next decade, driven by both public and private sector initiatives. Such investments are essential for ensuring reliable energy supply and facilitating the integration of renewable energy sources. Moreover, enhanced infrastructure not only supports existing industrial operations but also attracts new investments, fostering economic growth and job creation in the electrification sector. This trend highlights the interconnectedness of infrastructure development and the advancement of electrification technologies.

Regulatory Frameworks and Policy Support

The Industrial Electrification Market is significantly shaped by regulatory frameworks and policy support aimed at promoting electrification. Governments worldwide are implementing policies that incentivize the adoption of electrification technologies, including tax credits, grants, and subsidies. These initiatives are designed to encourage industries to transition from traditional energy sources to electrified solutions, thereby reducing environmental impact. Recent legislative measures have been introduced to streamline the permitting process for electrification projects, making it easier for companies to invest in new technologies. As regulatory support continues to evolve, it is likely to create a favorable environment for the growth of the electrification market. This alignment of policy and industry objectives not only facilitates compliance with environmental standards but also stimulates innovation and investment in electrification solutions.

Technological Innovations in Electrification

Technological advancements are playing a crucial role in shaping the Industrial Electrification Market. Innovations in electric motors, power electronics, and control systems are enhancing the performance and reliability of electrified industrial processes. For instance, the introduction of smart grid technologies allows for better integration of renewable energy sources, optimizing energy distribution and usage. Furthermore, the development of advanced sensors and automation technologies enables real-time monitoring and control of energy consumption, leading to improved operational efficiency. As industries adopt these cutting-edge technologies, the electrification of processes is expected to accelerate, potentially leading to a market growth rate of over 10% annually. This trend underscores the importance of continuous innovation in driving the electrification agenda across various sectors.